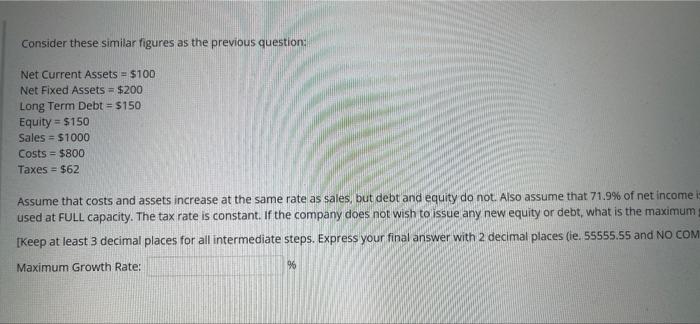

Question: Consider these similar figures as the previous question: Net Current Assets = $100 Net Fixed Assets = $200 Long Term Debt = $150 Equity =

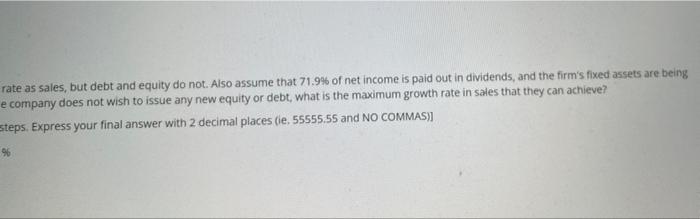

Consider these similar figures as the previous question: Net Current Assets = $100 Net Fixed Assets = $200 Long Term Debt = $150 Equity = $150 Sales = $1000 Costs = $800 Taxes = $62 Assume that costs and assets increase at the same rate as sales, but debt and equity do not. Also assume that 71.9% of net income i used at FULL capacity. The tax rate is constant. If the company does not wish to issue any new equity or debt, what is the maximum [Keep at least 3 decimal places for all intermediate steps. Express your final answer with 2 decimal places (ie. 55555.55 and NO COM Maximum Growth Rate: % rate as sales, but debt and equity do not. Also assume that 71.9% of net income is paid out in dividends, and the firm's fixed assets are being e company does not wish to issue any new equity or debt, what is the maximum growth rate in sales that they can achieve? steps. Express your final answer with 2 decimal places (ie. 55555.55 and NO COMMAS)]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts