Question: Consider this case: Defence Dynamics Co. is a small firm, and some managers worry about how soon the firm will receive cash flows from its

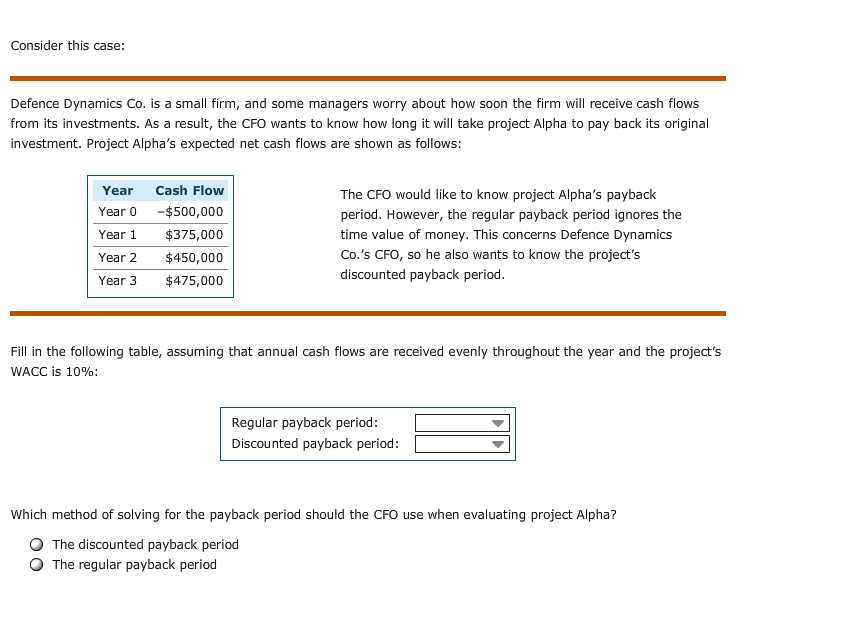

Consider this case: Defence Dynamics Co. is a small firm, and some managers worry about how soon the firm will receive cash flows from its investments. As a result, the CFO wants to know how long it will take project Alpha to pay back its original investment. Project Alpha's expected net cash flows are shown as follows: Year Cash Flow Year 0 -$500,000 Year $375,000 Year 2 $450,000 Year 3 $475,000 The CFO would like to know project Alpha's payback period. However, the regular payback period ignores the time value of money. This concerns Defence Dynamics Co.'s CFO,so he also wants to know the project's discounted payback period. Fill in the following table, assuming that annual cash flows are received evenly throughout the year and the project's WACC is 10% Regular payback period: Discounted payback period: Which method of solving for the payback period should the CFO use when evaluating project Alpha? O The discounted payback period O The regular payback period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts