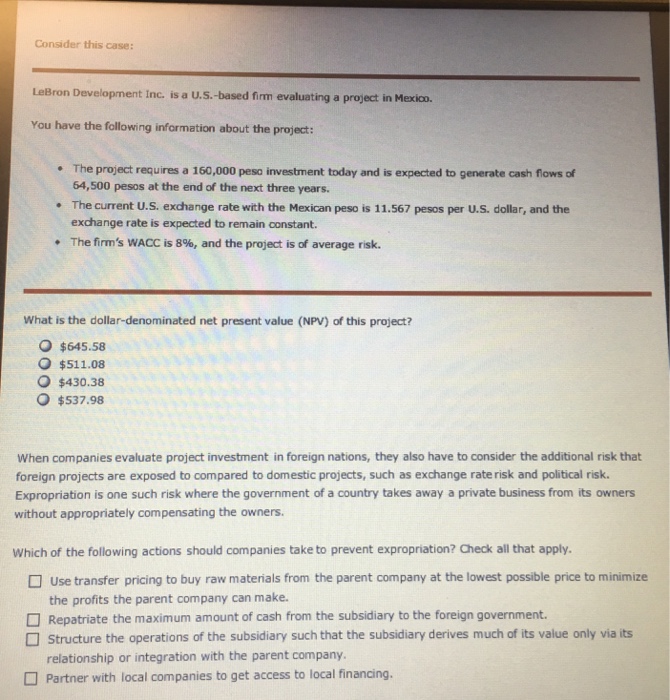

Question: Consider this case. LeBron Development Inc. is a U.S.-based firm evaluating a project in Mexico. You have the following information about the project: The project

LeBron Development Inc. is a U.S.-based firm evaluating a project in Mexico. You have the following information about the project: The project requires a 160,000 peso investment today and is expected to generate cash flows of 64,500 pesos at the end of the next three years. The current U.S. exchange rate with the Mexican peso is 11.567 pesos per U.S. dollar, and the exchange rate is expected to remain constant. The firm's WACC is 8%, and the project is of average risk. What is the dollar-denominated net present value (NPV) of this project? When companies evaluate project investment in foreign nations, they also have to consider the additional risk that foreign projects are exposed to compared to domestic projects, such as exchange rate risk and political risk. Expropriation is one such risk where the government of a country takes away a private business from its owners without appropriately compensating the owners. Which of the following actions should companies take to prevent expropriation? Check all that apply. Use transfer pricing to buy raw materials from the parent company at the lowest possible price to minimize the profits the parent company can make. Repatriate the maximum amount of cash from the subsidiary to the foreign government. Structure the operations of the subsidiary such that the subsidiary derives much of its value only via its relationship or integration with the parent company. Partner with local companies to get access to local financing

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts