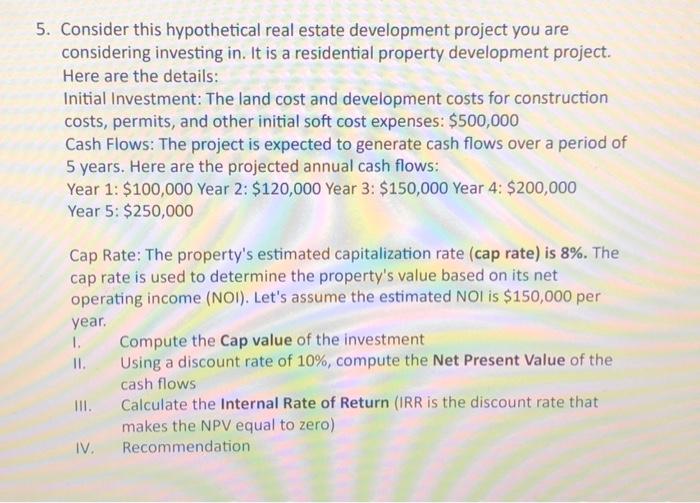

Question: Consider this hypothetical real estate development project you are considering investing in. It is a residential property development project. Here are the details: Initial Investment:

Consider this hypothetical real estate development project you are considering investing in. It is a residential property development project. Here are the details: Initial Investment: The land cost and development costs for construction costs, permits, and other initial soft cost expenses: $500,000 Cash Flows: The project is expected to generate cash flows over a period of 5 years. Here are the projected annual cash flows: Year 1: $100,000 Year 2:$120,000 Year 3: $150,000 Year 4:$200,000 Year 5: $250,000 Cap Rate: The property's estimated capitalization rate (cap rate) is 8%. The cap rate is used to determine the property's value based on its net operating income (NOI). Let's assume the estimated NOI is $150,000 per year. I. Compute the Cap value of the investment II. Using a discount rate of 10%, compute the Net Present Value of the cash flows III. Calculate the Internal Rate of Return (IRR is the discount rate that makes the NPV equal to zero) IV. Recommendation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts