Question: Consider this information for the next two questions: Here is your boss' unfinished analysis of some zero coupon bonds, as shown in the table. Your

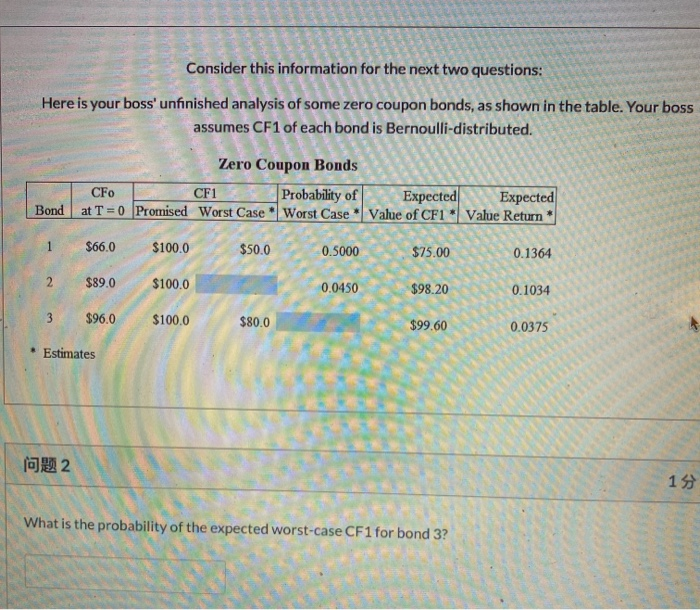

Consider this information for the next two questions: Here is your boss' unfinished analysis of some zero coupon bonds, as shown in the table. Your boss assumes CF1 of each bond is Bernoulli-distributed. Zero Coupon Bonds CFO CF1 Probability of Expected Expected at T = 0 Promised Worst Case Worst Case Value of CF1 * Value Return Bond 1 $66.0 $100.0 $50.0 0.5000 $75.00 0.1364 2 $89.0 $100.0 0.0450 $98.20 0.1034 3 $96.0 $100.0 $80.0 $99.60 0.0375 Estimates 1992 13 What is the probability of the expected worst-case CF1 for bond 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts