Question: Consider three 6-year, $1,000 face value bonds. All three bonds pay coupons annually. The yield to maturity for each bond is 7%. - Bond 1

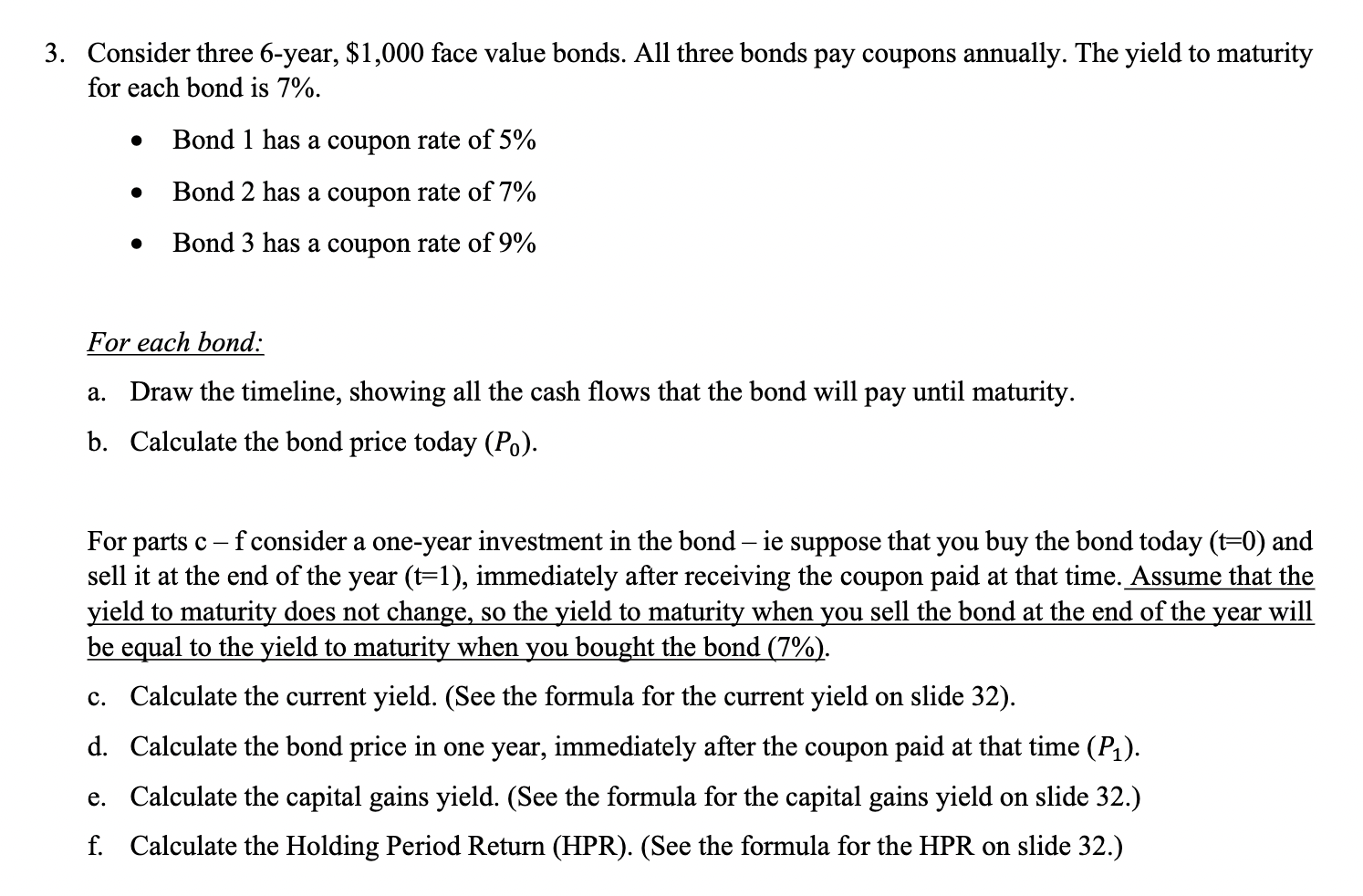

Consider three 6-year, $1,000 face value bonds. All three bonds pay coupons annually. The yield to maturity for each bond is 7%. - Bond 1 has a coupon rate of 5% - Bond 2 has a coupon rate of 7% - Bond 3 has a coupon rate of 9% For each bond: a. Draw the timeline, showing all the cash flows that the bond will pay until maturity. b. Calculate the bond price today (P0). For parts c - f consider a one-year investment in the bond - ie suppose that you buy the bond today (t=0) and sell it at the end of the year (t=1), immediately after receiving the coupon paid at that time. Assume that the yield to maturity does not change, so the yield to maturity when you sell the bond at the end of the year will be equal to the yield to maturity when you bought the bond (7\%). c. Calculate the current yield. (See the formula for the current yield on slide 32). d. Calculate the bond price in one year, immediately after the coupon paid at that time (P1). e. Calculate the capital gains yield. (See the formula for the capital gains yield on slide 32.) f. Calculate the Holding Period Return (HPR). (See the formula for the HPR on slide 32.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts