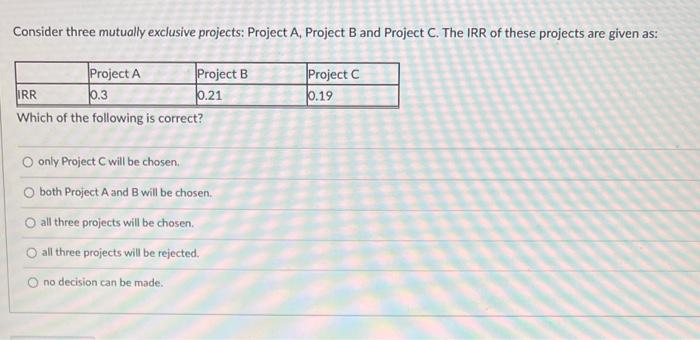

Question: Consider three mutually exclusive projects: Project A, Project B and Project C. The IRR of these projects are given as: Project A Project B IRR

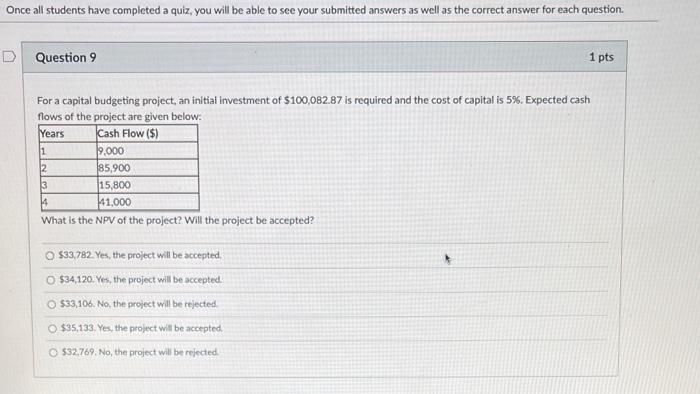

Consider three mutually exclusive projects: Project A, Project B and Project C. The IRR of these projects are given as: Project A Project B IRR 10.3 0.21 Which of the following is correct? Project C 0.19 only Project will be chosen both Project A and B will be chosen all three projects will be chosen all three projects will be rejected. no decision can be made. Once all students have completed a quiz, you will be able to see your submitted answers as well as the correct answer for each question. D Question 9 1 pts 1 For a capital budgeting project, an initial investment of $100,082.87 is required and the cost of capital is 5%. Expected cash flows of the project are given below: Years Cash Flow (s) 9,000 85.900 115,800 11,000 What is the NPV of the project? Will the project be accepted? 2 3 14 $33,782. Yes, the project will be accepted $34,120. Yes, the project will be accepted. $33,106. No, the project will be rejected O $35,133. Yes, the project will be accepted. $32.769. No, the project will be rejected

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts