Question: Consider two corporate bonds, A and B, each with a face value of $1,000, remaining term of 10 years and yield-to-maturity of 8% per annum.

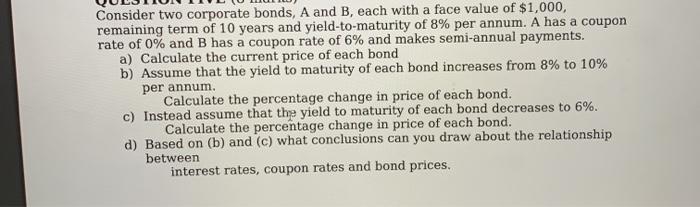

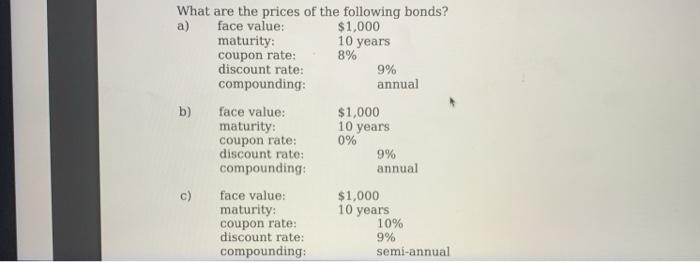

Consider two corporate bonds, A and B, each with a face value of $1,000, remaining term of 10 years and yield-to-maturity of 8% per annum. A has a coupon rate of 0% and B has a coupon rate of 6% and makes semi-annual payments. a) Calculate the current price of each bond b) Assume that the yield to maturity of each bond increases from 8% to 10% per annum. Calculate the percentage change in price of each bond. c) Instead assume that the yield to maturity of each bond decreases to 6%. Calculate the percentage change in price of each bond. d) Based on (b) and (c) what conclusions can you draw about the relationship between interest rates, coupon rates and bond prices, What are the prices of the following bonds? a) face value: $1,000 maturity: 10 years coupon rate: 8% discount rate: 9% compounding: annual b) face value: $1,000 maturity: 10 years coupon rate: 0% discount rate: 9% compounding: annual c) face value: $1,000 maturity: 10 years coupon rate: 10% discount rate: 9% compounding: semi-annual

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts