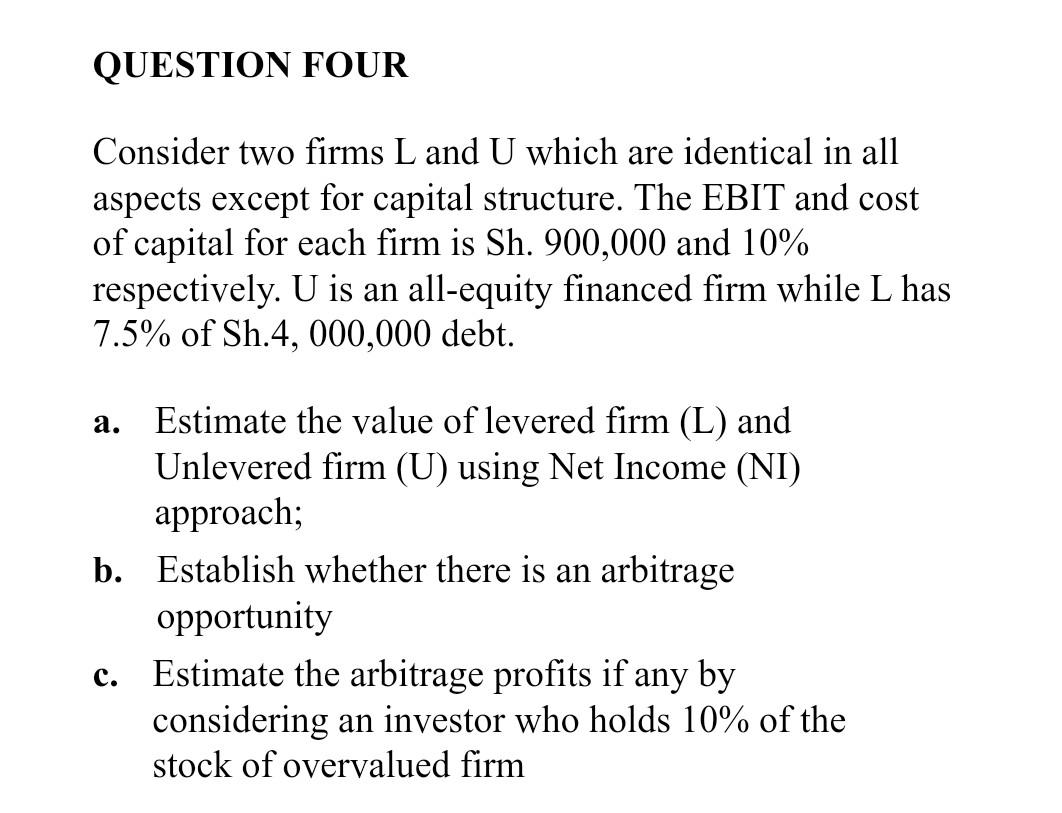

Question: Consider two firms ( mathrm{L} ) and ( mathrm{U} ) which are identical in all aspects except for capital structure. The EBIT and cost of

Consider two firms \\( \\mathrm{L} \\) and \\( \\mathrm{U} \\) which are identical in all aspects except for capital structure. The EBIT and cost of capital for each firm is Sh. 900,000 and 10\\% respectively. \\( \\mathrm{U} \\) is an all-equity financed firm while \\( \\mathrm{L} \\) has \7.5 of Sh. \\( 4,000,000 \\) debt. a. Estimate the value of levered firm (L) and Unlevered firm (U) using Net Income (NI) approach; b. Establish whether there is an arbitrage opportunity c. Estimate the arbitrage profits if any by considering an investor who holds \10 of the stock of overvalued firm

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts