Question: Consider two identical companies except that they have different probabilities of default. Safe Corporation is a very safe company. It has a zero probability of

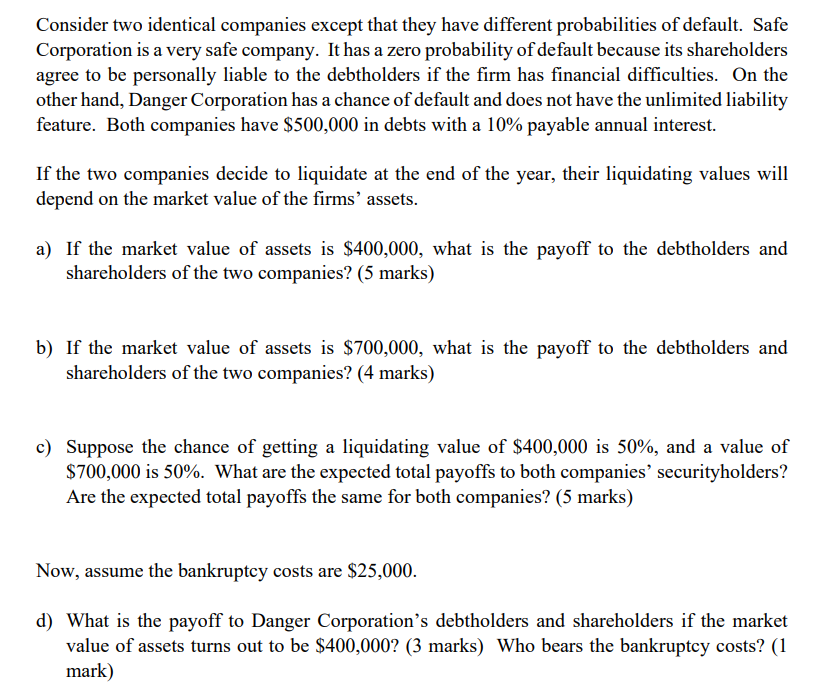

Consider two identical companies except that they have different probabilities of default. Safe Corporation is a very safe company. It has a zero probability of default because its shareholders agree to be personally liable to the debtholders if the firm has financial difficulties. On the other hand, Danger Corporation has a chance of default and does not have the unlimited liability feature. Both companies have $500,000 in debts with a 10% payable annual interest. If the two companies decide to liquidate at the end of the year, their liquidating values will depend on the market value of the firms' assets. a) If the market value of assets is $400,000, what is the payoff to the debtholders and shareholders of the two companies? (5 marks) b) If the market value of assets is $700,000, what is the payoff to the debtholders and shareholders of the two companies? (4 marks) c) Suppose the chance of getting a liquidating value of $400,000 is 50%, and a value of $700,000 is 50%. What are the expected total payoffs to both companies' securityholders? Are the expected total payoffs the same for both companies? (5 marks) Now, assume the bankruptcy costs are $25,000. d) What is the payoff to Danger Corporation's debtholders and shareholders if the market value of assets turns out to be $400,000? (3 marks) Who bears the bankruptcy costs? (1 mark) Consider two identical companies except that they have different probabilities of default. Safe Corporation is a very safe company. It has a zero probability of default because its shareholders agree to be personally liable to the debtholders if the firm has financial difficulties. On the other hand, Danger Corporation has a chance of default and does not have the unlimited liability feature. Both companies have $500,000 in debts with a 10% payable annual interest. If the two companies decide to liquidate at the end of the year, their liquidating values will depend on the market value of the firms' assets. a) If the market value of assets is $400,000, what is the payoff to the debtholders and shareholders of the two companies? (5 marks) b) If the market value of assets is $700,000, what is the payoff to the debtholders and shareholders of the two companies? (4 marks) c) Suppose the chance of getting a liquidating value of $400,000 is 50%, and a value of $700,000 is 50%. What are the expected total payoffs to both companies' securityholders? Are the expected total payoffs the same for both companies? (5 marks) Now, assume the bankruptcy costs are $25,000. d) What is the payoff to Danger Corporation's debtholders and shareholders if the market value of assets turns out to be $400,000? (3 marks) Who bears the bankruptcy costs? (1 mark)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts