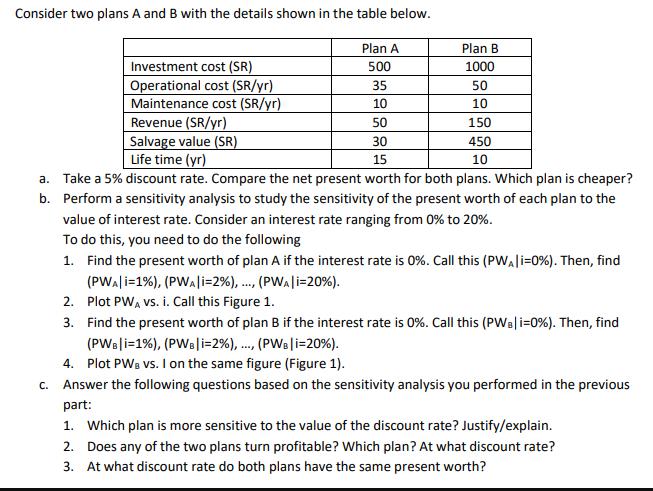

Question: Consider two plans A and B with the details shown in the table below. Plan A 500 35 10 Revenue (SR/yr) 50 Salvage value

Consider two plans A and B with the details shown in the table below. Plan A 500 35 10 Revenue (SR/yr) 50 Salvage value (SR) 30 Life time (yr) 15 a. Take a 5% discount rate. Compare the net present worth for both plans. Which plan is cheaper? b. Perform a sensitivity analysis to study the sensitivity of the present worth of each plan to the value of interest rate. Consider an interest rate ranging from 0% to 20%. To do this, you need to do the following 1. Find the present worth of plan A if the interest rate is 0%. Call this (PW|i=0%). Then, find (PWA|I=1%), (PWA|i=2%), ..., (PWA | I=20%). 2. Plot PWA vs. i. Call this Figure 1. 3. Find the present worth of plan B if the interest rate is 0%. Call this (PWB | i=0%). Then, find (PWB | i=1%), (PWB | i=2%), ..., (PWB | i=20%). 4. Plot PWB vs. I on the same figure (Figure 1). c. Answer the following questions based on the sensitivity analysis you performed in the previous Investment cost (SR) Operational cost (SR/yr) Maintenance cost (SR/yr) Plan B 1000 50 10 150 450 10 part: 1. Which plan is more sensitive to the value of the discount rate? Justify/explain. 2. Does any of the two plans turn profitable? Which plan? At what discount rate? 3. At what discount rate do both plans have the same present worth?

Step by Step Solution

3.51 Rating (151 Votes )

There are 3 Steps involved in it

To compare the net present worth of plans A and B and perform a sensitivity analysis we will use the given details and discount rates ranging from 0 to 20 Lets calculate the present worth for each pla... View full answer

Get step-by-step solutions from verified subject matter experts