Question: Consider two probabilities P and Q defined on the sample space 05 (w1, w2, w3) in the following way: p(w1) = 0, p(w2)=0.4, p(w3)

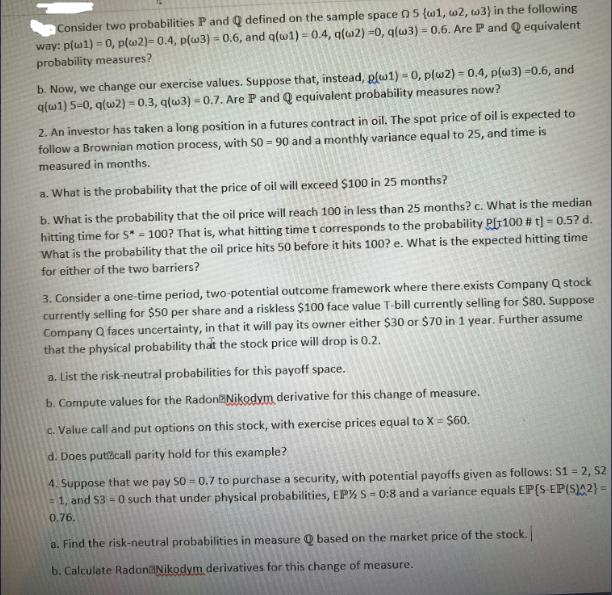

Consider two probabilities P and Q defined on the sample space 05 (w1, w2, w3) in the following way: p(w1) = 0, p(w2)=0.4, p(w3) -0.6, and a(w1)=0.4, q(w2) -0, q(w3) = 0.6. Are P and Q equivalent probability measures? b. Now, we change our exercise values. Suppose that, instead, p(w1) = 0, p(w2) = 0.4, p(w3) -0.6, and q(w1) 5-0, q(w2)=0.3, q(w3) -0.7. Are P and Q equivalent probability measures now? 2. An investor has taken a long position in a futures contract in oil. The spot price of oil is expected to follow a Brownian motion process, with 50-90 and a monthly variance equal to 25, and time is measured in months. a. What is the probability that the price of oil will exceed $100 in 25 months? b. What is the probability that the oil price will reach 100 in less than 25 months? c. What is the median hitting time for 5* - 100? That is, what hitting time t corresponds to the probability P100 #t] -0.5? d. What is the probability that the oil price hits 50 before it hits 100? e. What is the expected hitting time for either of the two barriers? 3. Consider a one-time period, two-potential outcome framework where there exists Company Q stock currently selling for $50 per share and a riskless $100 face value T-bill currently selling for $80. Suppose Company Q faces uncertainty, in that it will pay its owner either $30 or $70 in 1 year. Further assume that the physical probability that the stock price will drop is 0.2. a. List the risk-neutral probabilities for this payoff space. b. Compute values for the Radon Nikodym derivative for this change of measure. c. Value call and put options on this stock, with exercise prices equal to X = $60. d. Does putticall parity hold for this example? 4. Suppose that we pay S0-0.7 to purchase a security, with potential payoffs given as follows: S1 = 2, 52 = 1, and 53-0 such that under physical probabilities, EPS-0:8 and a variance equals EP{S-EP(S)^2)= 0.76. a. Find the risk-neutral probabilities in measure based on the market price of the stock. b. Calculate Radon Nikodym derivatives for this change of measure.

Step by Step Solution

3.34 Rating (160 Votes )

There are 3 Steps involved in it

Here are the solutions to the probability problems 1a Are P and Q equivalent probability measures No ... View full answer

Get step-by-step solutions from verified subject matter experts