Question: Consider two put options which have identical maturity T and underlying security. Option 1 has strike price Ki and option 2 has strike price K2,

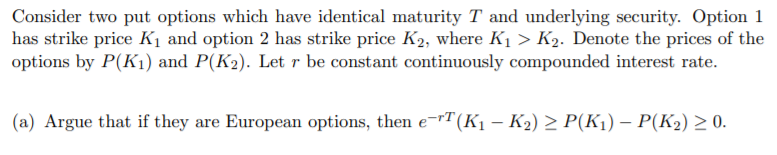

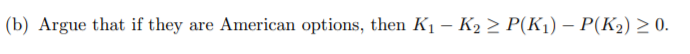

Consider two put options which have identical maturity T and underlying security. Option 1 has strike price Ki and option 2 has strike price K2, where Ki > K2. Denote the prices of the options by P(K1) and P(K2). Let r be constant continuously compounded interest rate. (a) Argue that if they are European options, then e-T(K1 - K2) > P(K1) - P(K2) > 0. (b) Argue that if they are American options, then K1 - K2 > P(K1) - P(K2) > 0. Consider two put options which have identical maturity T and underlying security. Option 1 has strike price Ki and option 2 has strike price K2, where Ki > K2. Denote the prices of the options by P(K1) and P(K2). Let r be constant continuously compounded interest rate. (a) Argue that if they are European options, then e-T(K1 - K2) > P(K1) - P(K2) > 0. (b) Argue that if they are American options, then K1 - K2 > P(K1) - P(K2) > 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts