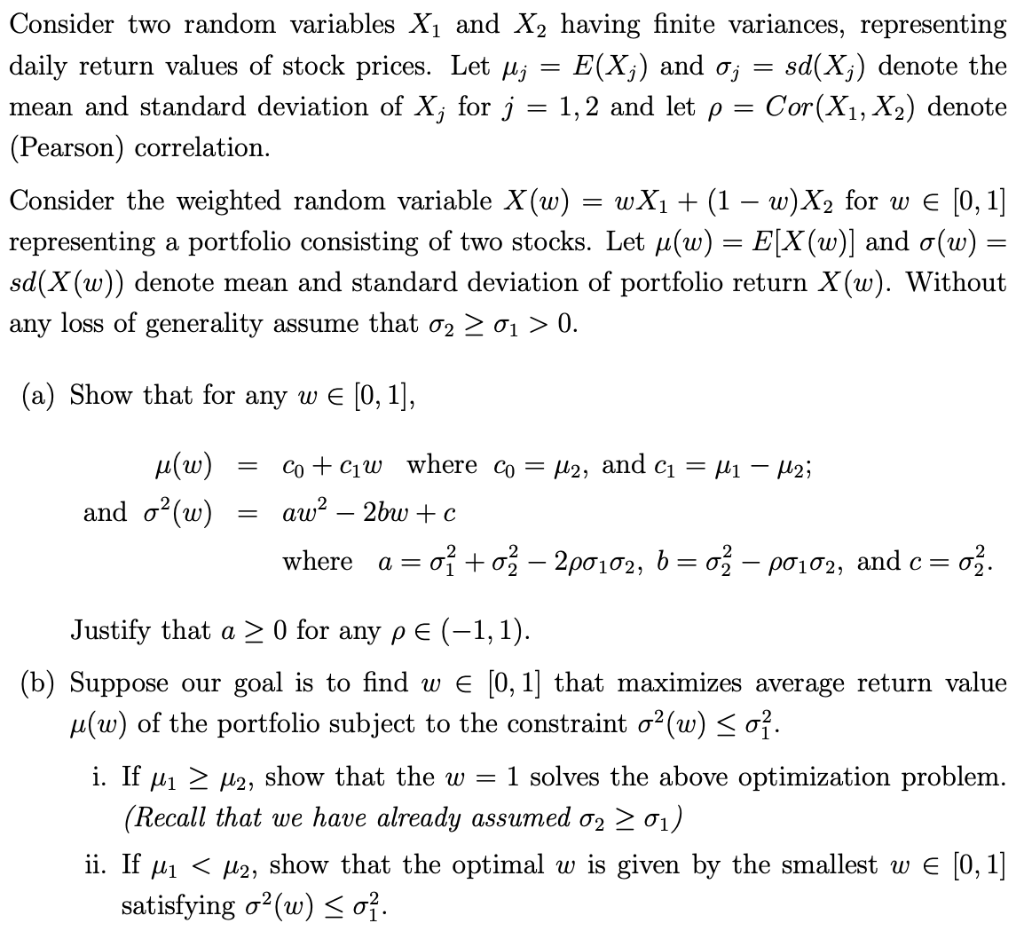

Question: - Consider two random variables X1 and X2 having finite variances, representing daily return values of stock prices. Let Mj E(X;) and oj sd(X;) denote

- Consider two random variables X1 and X2 having finite variances, representing daily return values of stock prices. Let Mj E(X;) and oj sd(X;) denote the mean and standard deviation of X; for j = 1, 2 and let p = Cor(X1, X2) denote (Pearson) correlation. Consider the weighted random variable X(w) wX1 + (1 w)X2 for we [0, 1] representing a portfolio consisting of two stocks. Let u(w) = E(X(w)] and o(w) = sd(X(w)) denote mean and standard deviation of portfolio return X(w). Without any loss of generality assume that 02 201 > 0. (a) Show that for any w e [0, 1], u(w) and o(w) Co + C1w where co = M2, ar C1 = M1 2; aw2 2bw + c where a = o + o 200102, b = o p0102, and c = 02. Justify that a > 0 for any pe(-1,1). (b) Suppose our goal is to find w E [0, 1] that maximizes average return value u(w) of the portfolio subject to the constraint o(w)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts