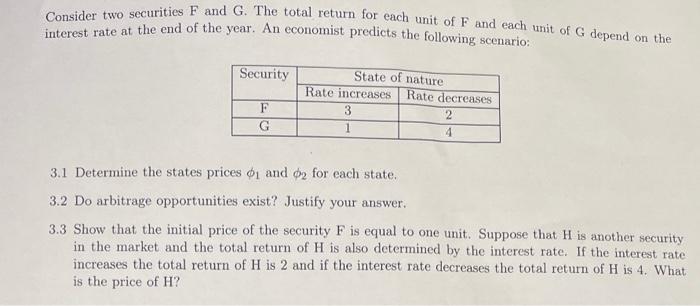

Question: Consider two securities F and G. The total return for each unit of F and each unit of G depend on the interest rate at

Consider two securities F and G. The total return for each unit of F and each unit of G depend on the interest rate at the end of the year. An economist predicts the following scenario: Security State of nature Rate increases Rate decreases 3 2 1 4 F G 3.1 Determine the states prices on and $2 for each state. 3.2 Do arbitrage opportunities exist? Justify your answer. 3.3 Show that the initial price of the security F is equal to one unit. Suppose that H is another security in the market and the total return of H is also determined by the interest rate. If the interest rate increases the total return of H is 2 and if the interest rate decreases the total return of H is 4. What is the price of H? Consider two securities F and G. The total return for each unit of F and each unit of G depend on the interest rate at the end of the year. An economist predicts the following scenario: Security State of nature Rate increases Rate decreases 3 2 1 4 F G 3.1 Determine the states prices on and $2 for each state. 3.2 Do arbitrage opportunities exist? Justify your answer. 3.3 Show that the initial price of the security F is equal to one unit. Suppose that H is another security in the market and the total return of H is also determined by the interest rate. If the interest rate increases the total return of H is 2 and if the interest rate decreases the total return of H is 4. What is the price of H

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts