Question: Consider two stocks, A and B, whose returns in a boom and a recession are given in the table below. Suppose that there is a

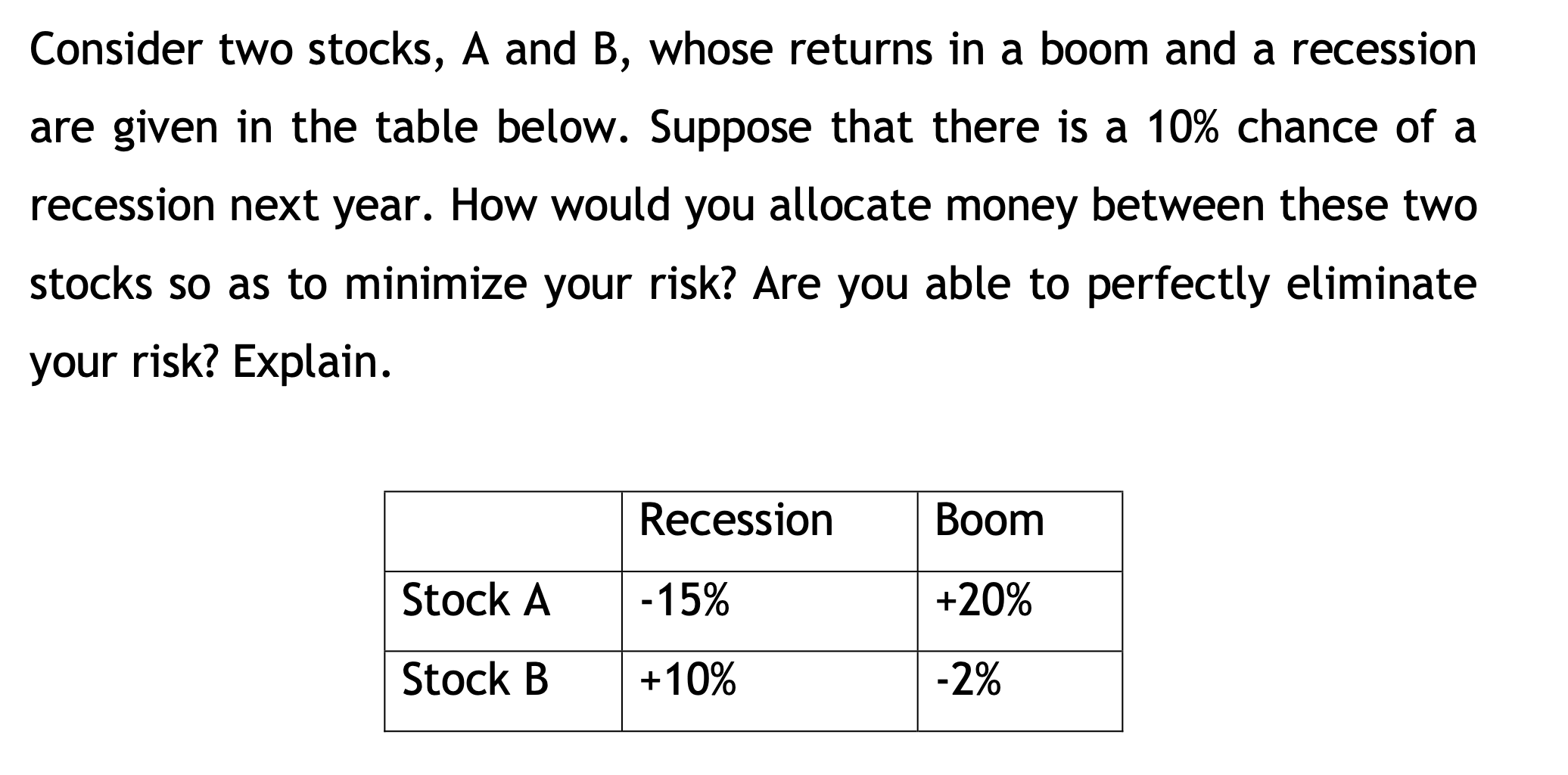

Consider two stocks, A and B, whose returns in a boom and a recession are given in the table below. Suppose that there is a 10% chance of a recession next year. How would you allocate money between these two stocks so as to minimize your risk? Are you able to perfectly eliminate your risk? Explain. Recession Boom Stock A -15% +20% Stock B +10% -2%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts