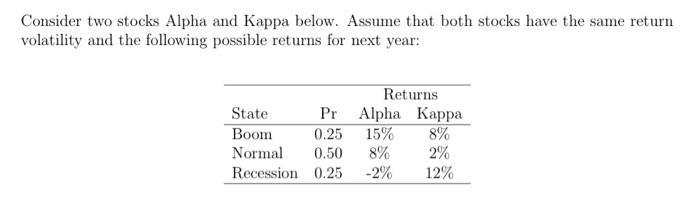

Question: Consider two stocks Alpha and Kappa below. Assume that both stocks have the same return volatility and the following possible returns for next year:

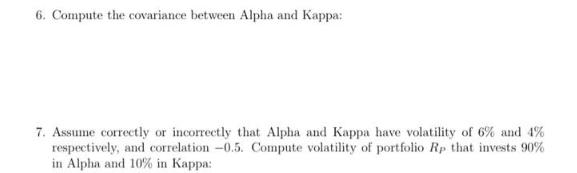

Consider two stocks Alpha and Kappa below. Assume that both stocks have the same return volatility and the following possible returns for next year: Returns State Boom Normal 0.50 Recession 0.25 Pr Alpha Kappa 0.25 15% 8% 8% 2% -2% 12% 6. Compute the covariance between Alpha and Kappa: 7. Assume correctly or incorrectly that Alpha and Kappa have volatility of 6% and 4% respectively, and correlation -0.5. Compute volatility of portfolio Rp that invests 90% in Alpha and 10% in Kappa:

Step by Step Solution

3.46 Rating (162 Votes )

There are 3 Steps involved in it

Solution To compute the covariance between Alpha and Kappa we first need to compute the expected ret... View full answer

Get step-by-step solutions from verified subject matter experts