Question: Consider two stocks, indexed by j = {1, 2}, with current values St,1 = 1000 and St,2 = 100 in some unit of currency. The

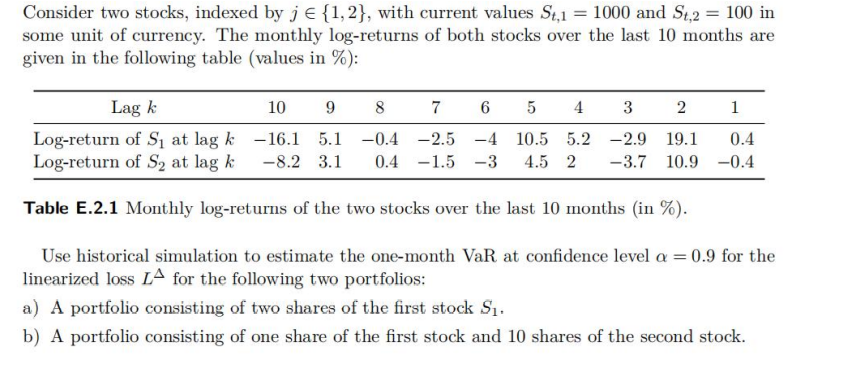

Consider two stocks, indexed by j = {1, 2}, with current values St,1 = 1000 and St,2 = 100 in some unit of currency. The monthly log-returns of both stocks over the last 10 months are given in the following table (values in %): Lag k 10 9 8 5 4 3 2 1 7 6 Log-return of S at lag k-16.1 5.1 -0.4 -2.5 -4 10.5 5.2 -2.9 19.1 0.4 Log-return of S at lag k -8.2 3.1 0.4 -1.5 -3 4.5 2 -3.7 10.9 -0.4 Table E.2.1 Monthly log-returns of the two stocks over the last 10 months (in %). Use historical simulation to estimate the one-month VaR at confidence level a = 0.9 for the linearized loss LA for the following two portfolios: a) A portfolio consisting of two shares of the first stock $. b) A portfolio consisting of one share of the first stock and 10 shares of the second stock. Consider two stocks, indexed by j = {1, 2}, with current values St,1 = 1000 and St,2 = 100 in some unit of currency. The monthly log-returns of both stocks over the last 10 months are given in the following table (values in %): Lag k 10 9 8 5 4 3 2 1 7 6 Log-return of S at lag k-16.1 5.1 -0.4 -2.5 -4 10.5 5.2 -2.9 19.1 0.4 Log-return of S at lag k -8.2 3.1 0.4 -1.5 -3 4.5 2 -3.7 10.9 -0.4 Table E.2.1 Monthly log-returns of the two stocks over the last 10 months (in %). Use historical simulation to estimate the one-month VaR at confidence level a = 0.9 for the linearized loss LA for the following two portfolios: a) A portfolio consisting of two shares of the first stock $. b) A portfolio consisting of one share of the first stock and 10 shares of the second stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts