Question: Consider two stocks with returns modeled as standard normal distributions (u= 0,02 = 1). Further, let these stocks have a correlation of -2. Now consider

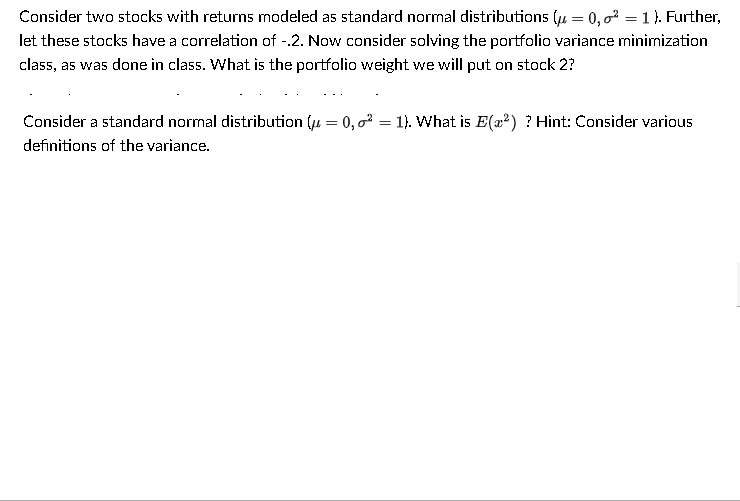

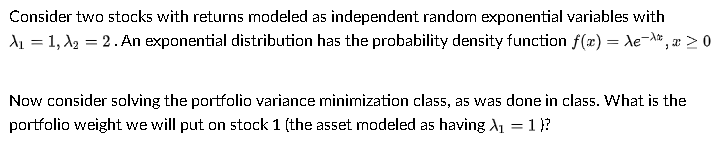

Consider two stocks with returns modeled as standard normal distributions (u= 0,02 = 1). Further, let these stocks have a correlation of -2. Now consider solving the portfolio variance minimization class, as was done in class. What is the portfolio weight we will put on stock 2? Consider a standard normal distribution (u= 0,02 = 1). What is E(22) ? Hint: Consider various definitions of the variance. Consider two stocks with returns modeled as independent random exponential variables with XL = 1, 12 = 2. An exponential distribution has the probability density function f(c) = le-**, x > 0 Now consider solving the portfolio variance minimization class, as was done in class. What is the portfolio weight we will put on stock 1 (the asset modeled as having Xi = 1)? Consider two stocks with returns modeled as standard normal distributions (u= 0,02 = 1). Further, let these stocks have a correlation of -2. Now consider solving the portfolio variance minimization class, as was done in class. What is the portfolio weight we will put on stock 2? Consider a standard normal distribution (u= 0,02 = 1). What is E(22) ? Hint: Consider various definitions of the variance. Consider two stocks with returns modeled as independent random exponential variables with XL = 1, 12 = 2. An exponential distribution has the probability density function f(c) = le-**, x > 0 Now consider solving the portfolio variance minimization class, as was done in class. What is the portfolio weight we will put on stock 1 (the asset modeled as having Xi = 1)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts