Question: Consider two zero-coupon bonds and both have face value at $1000. Bond A is a 2-year bond that you purchased at $775. Bond B

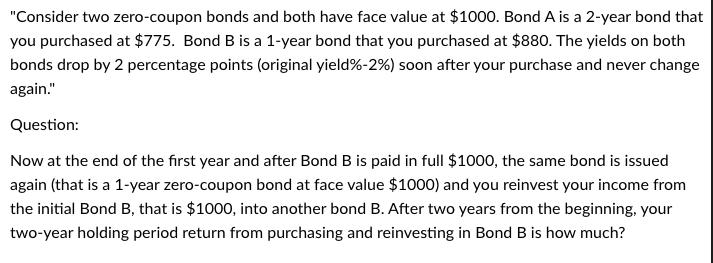

"Consider two zero-coupon bonds and both have face value at $1000. Bond A is a 2-year bond that you purchased at $775. Bond B is a 1-year bond that you purchased at $880. The yields on both bonds drop by 2 percentage points (original yield % -2%) soon after your purchase and never change again." Question: Now at the end of the first year and after Bond B is paid in full $1000, the same bond is issued again (that is a 1-year zero-coupon bond at face value $1000) and you reinvest your income from the initial Bond B, that is $1000, into another bond B. After two years from the beginning, your two-year holding period return from purchasing and reinvesting in Bond B is how much? "Consider two zero-coupon bonds and both have face value at $1000. Bond A is a 2-year bond that you purchased at $775. Bond B is a 1-year bond that you purchased at $880. The yields on both bonds drop by 2 percentage points (original yield % -2%) soon after your purchase and never change again." Question: Now at the end of the first year and after Bond B is paid in full $1000, the same bond is issued again (that is a 1-year zero-coupon bond at face value $1000) and you reinvest your income from the initial Bond B, that is $1000, into another bond B. After two years from the beginning, your two-year holding period return from purchasing and reinvesting in Bond B is how much?

Step by Step Solution

3.47 Rating (150 Votes )

There are 3 Steps involved in it

When you purchased Bond A at 775 you effectively locked in a yield of Yield of Bond A Face value Pur... View full answer

Get step-by-step solutions from verified subject matter experts