Question: Considering the data below, develop free cash flows to evaluate the project: Initial investments (divide into investments and costs): Rent for 3 month in advance

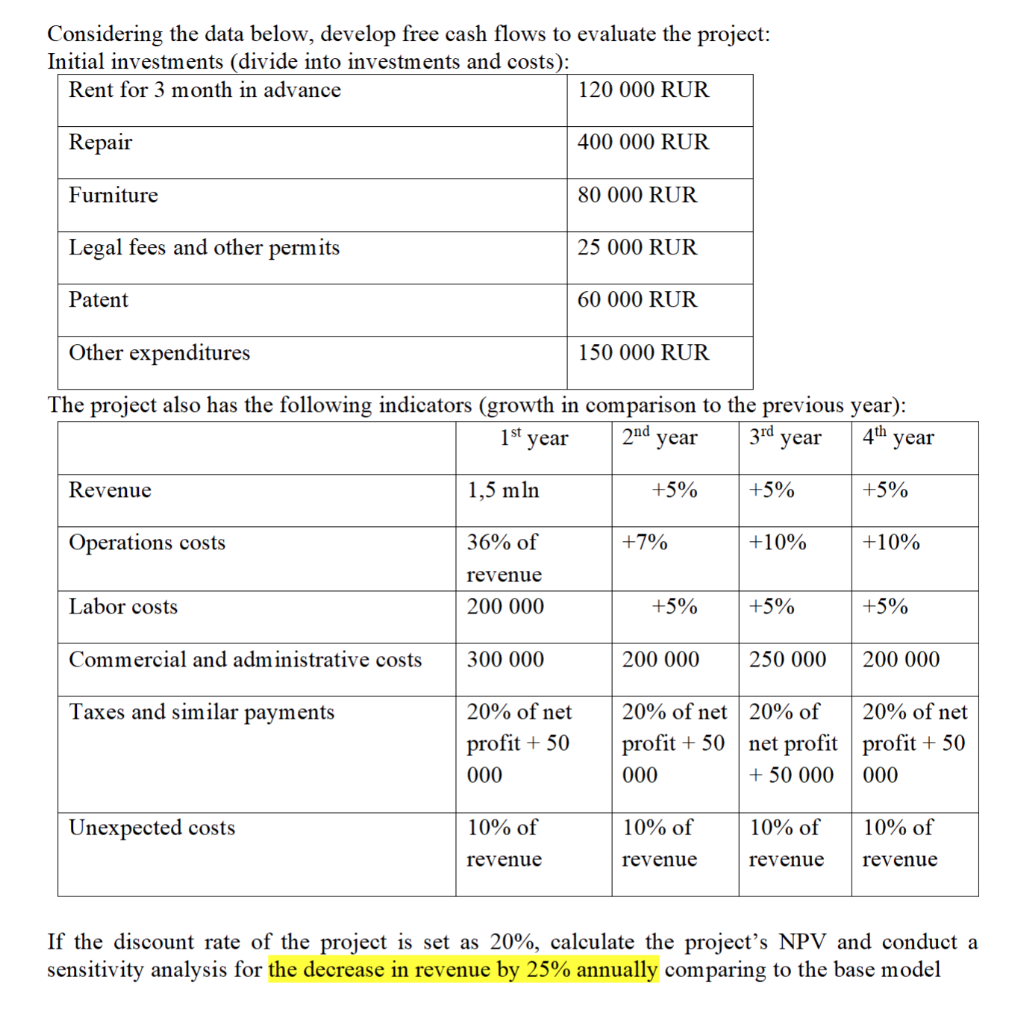

Considering the data below, develop free cash flows to evaluate the project: Initial investments (divide into investments and costs): Rent for 3 month in advance 120 000 RUR Repair 400 000 RUR Furniture 80 000 RUR Legal fees and other permits 25 000 RUR Patent 60 000 RUR Other expenditures 150 000 RUR The project also has the following indicators (growth in comparison to the previous year): 2nd year year 1st year 3rd 4th year Revenue 1,5 mln +5% +5% +5% Operations costs 36% of +7% +10% +10% revenue Labor costs 200 000 +5% +5% +5% Commercial and administrative costs 300 000 200 000 250 000 200 000 Taxes and similar payments 20% of net profit + 50 000 20% of net 20% of 20% of net profit + 50 net profit profit + 50 000 + 50 000 000 Unexpected costs 10% of 10% of 10% of 10% of revenue revenue revenue revenue If the discount rate of the project is set as 20%, calculate the project's NPV and conduct a sensitivity analysis for the decrease in revenue by 25% annually comparing to the base model Considering the data below, develop free cash flows to evaluate the project: Initial investments (divide into investments and costs): Rent for 3 month in advance 120 000 RUR Repair 400 000 RUR Furniture 80 000 RUR Legal fees and other permits 25 000 RUR Patent 60 000 RUR Other expenditures 150 000 RUR The project also has the following indicators (growth in comparison to the previous year): 2nd year year 1st year 3rd 4th year Revenue 1,5 mln +5% +5% +5% Operations costs 36% of +7% +10% +10% revenue Labor costs 200 000 +5% +5% +5% Commercial and administrative costs 300 000 200 000 250 000 200 000 Taxes and similar payments 20% of net profit + 50 000 20% of net 20% of 20% of net profit + 50 net profit profit + 50 000 + 50 000 000 Unexpected costs 10% of 10% of 10% of 10% of revenue revenue revenue revenue If the discount rate of the project is set as 20%, calculate the project's NPV and conduct a sensitivity analysis for the decrease in revenue by 25% annually comparing to the base model

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts