Question: Considering the following data, explain how you would build a synthetic forward for a US importer of Chinese toys who has to pay 1

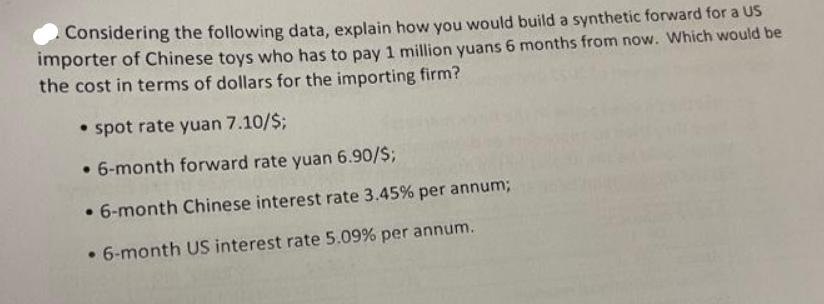

Considering the following data, explain how you would build a synthetic forward for a US importer of Chinese toys who has to pay 1 million yuans 6 months from now. Which would be the cost in terms of dollars for the importing firm? spot rate yuan 7.10/$; 6-month forward rate yuan 6.90/$; 6-month Chinese interest rate 3.45% per annum; 6-month US interest rate 5.09% per annum.

Step by Step Solution

There are 3 Steps involved in it

To hedge against currency risk the US importer can enter into a forward contract to lock in a future ... View full answer

Get step-by-step solutions from verified subject matter experts