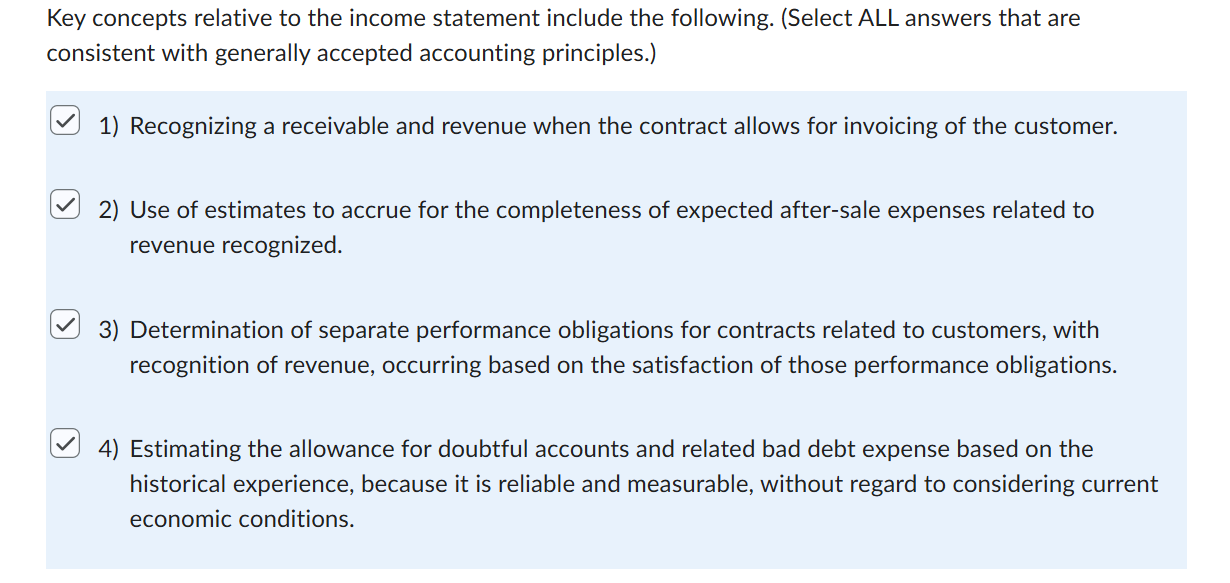

Question: consistent with generally accepted accounting principles. ) 1 ) Recognizing a receivable and revenue when the contract allows for invoicing of the customer. 2 )

consistent with generally accepted accounting principles. Recognizing a receivable and revenue when the contract allows for invoicing of the customer. Use of estimates to accrue for the completeness of expected aftersale expenses related to revenue recognized. Determination of separate performance obligations for contracts related to customers, with recognition of revenue, occurring based on the satisfaction of those performance obligations. Estimating the allowance for doubtful accounts and related bad debt expense based on the historical experience, because it is reliable and measurable, without regard to considering current economic conditions.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock