Question: Consistent with IRS revenue code 162(m), companies were able to deduct non-performance- based compensation for a single executive to the extent that it does not

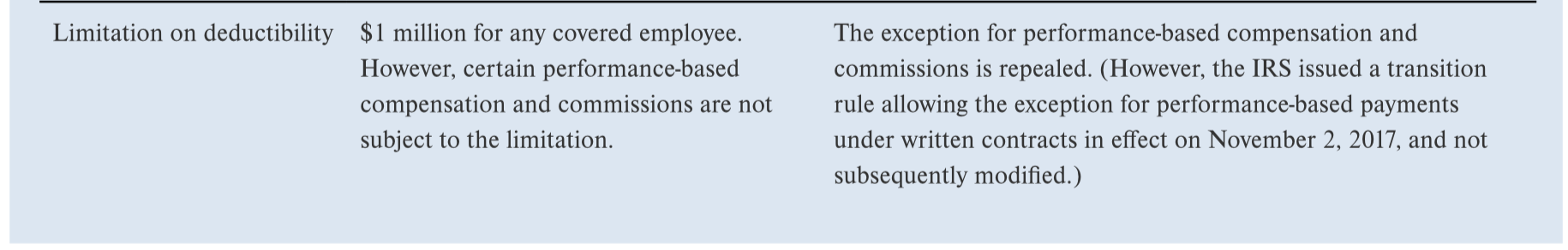

Consistent with IRS revenue code 162(m), companies were able to deduct non-performance- based compensation for a single executive to the extent that it does not exceed $1 million. Under the new Tax Cuts and Jobs Act, this limit has been increased to $5 million. increased to $10 million. decreased to $500,000. eliminated. . . 0 . Limitation on deductibility $1 million for any covered employee. However, certain performance-based compensation and commissions are not subject to the limitation. The exception for performance-based compensation and commissions is repealed. (However, the IRS issued a transition a rule allowing the exception for performance-based payments under written contracts in effect on November 2, 2017, and not subsequently modified.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts