Question: Consolidated Balance Sheet Working Paper, Previously Reported Goodwill Progres- sive Corporation acquired all of the outstanding stock of Static Company on June 30, 2019, by

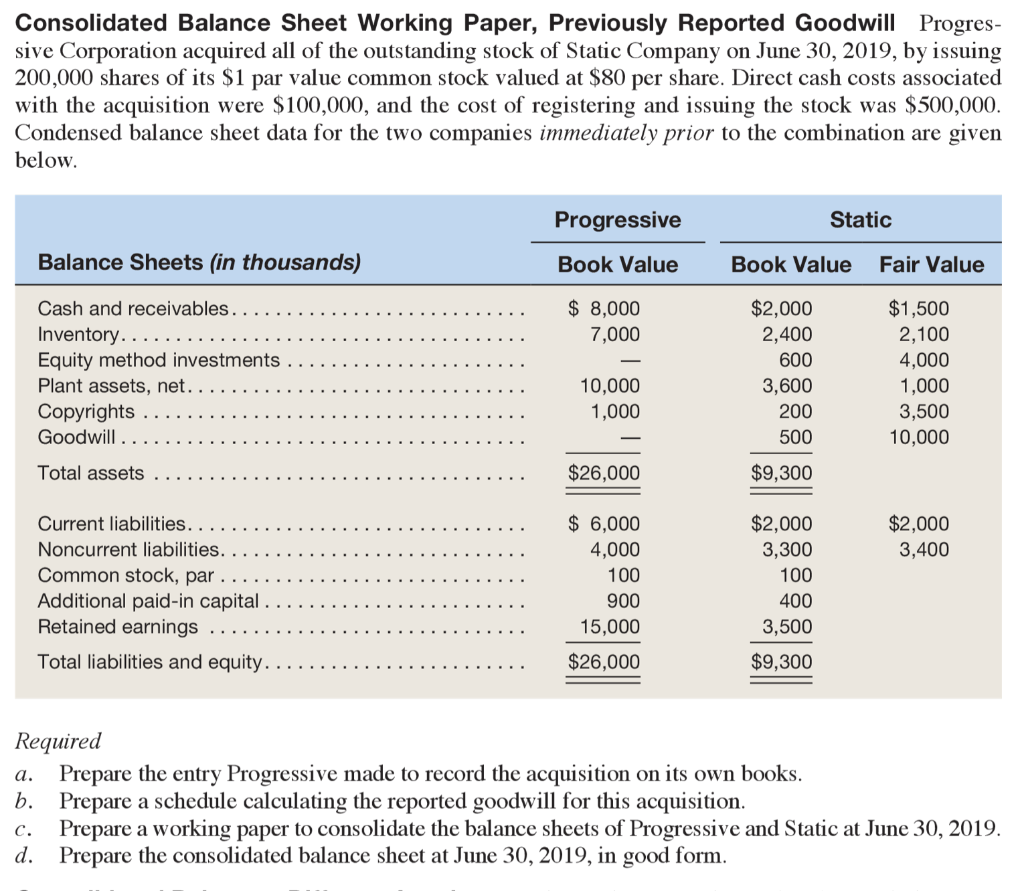

Consolidated Balance Sheet Working Paper, Previously Reported Goodwill Progres- sive Corporation acquired all of the outstanding stock of Static Company on June 30, 2019, by issuing 200,000 shares of its $1 par value common stock valued at $80 per share. Direct cash costs associated with the acquisition were $100,000, and the cost of registering and issuing the stock was $500,000. Condensed balance sheet data for the two companies immediately prior to the combination are given below. Progressive Static Balance Sheets (in thousands) Book Value Book Value Fair Value $ 8,000 7,000 Cash and receivables. ... Inventory............ Equity method investments Plant assets, net....... Copyrights ... Goodwill .......... $2,000 2,400 600 3,600 200 500 $1,500 2,100 4,000 1,000 3,500 10,000 10,000 1,000 Total assets ........... $26,000 $9,300 $ 6,000 4,000 $2,000 3,300 $2,000 3,400 100 Current liabilities. ........... Noncurrent liabilities. . . . . . . . . Common stock, par ........ Additional paid-in capital ...... Retained earnings ............. Total liabilities and equity....... 100 400 900 15,000 $26,000 3,500 $9,300 Required a. Prepare the entry Progressive made to record the acquisition on its own books. b. Prepare a schedule calculating the reported goodwill for this acquisition. c. Prepare a working paper to consolidate the balance sheets of Progressive and Static at June 30, 2019. d. Prepare the consolidated balance sheet at June 30, 2019, in good form. Consolidated Balance Sheet Working Paper, Previously Reported Goodwill Progres- sive Corporation acquired all of the outstanding stock of Static Company on June 30, 2019, by issuing 200,000 shares of its $1 par value common stock valued at $80 per share. Direct cash costs associated with the acquisition were $100,000, and the cost of registering and issuing the stock was $500,000. Condensed balance sheet data for the two companies immediately prior to the combination are given below. Progressive Static Balance Sheets (in thousands) Book Value Book Value Fair Value $ 8,000 7,000 Cash and receivables. ... Inventory............ Equity method investments Plant assets, net....... Copyrights ... Goodwill .......... $2,000 2,400 600 3,600 200 500 $1,500 2,100 4,000 1,000 3,500 10,000 10,000 1,000 Total assets ........... $26,000 $9,300 $ 6,000 4,000 $2,000 3,300 $2,000 3,400 100 Current liabilities. ........... Noncurrent liabilities. . . . . . . . . Common stock, par ........ Additional paid-in capital ...... Retained earnings ............. Total liabilities and equity....... 100 400 900 15,000 $26,000 3,500 $9,300 Required a. Prepare the entry Progressive made to record the acquisition on its own books. b. Prepare a schedule calculating the reported goodwill for this acquisition. c. Prepare a working paper to consolidate the balance sheets of Progressive and Static at June 30, 2019. d. Prepare the consolidated balance sheet at June 30, 2019, in good form

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts