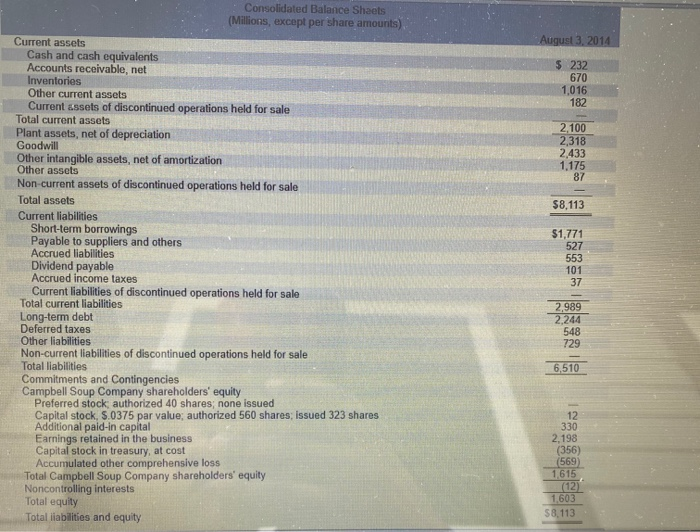

Question: Consolidated Balance Sheets (Millions, except per share amounts) August 3, 2014 $ 232 670 1,016 182 2.100 2.318 2,433 1,175 87 $8,113 $1,771 527 553

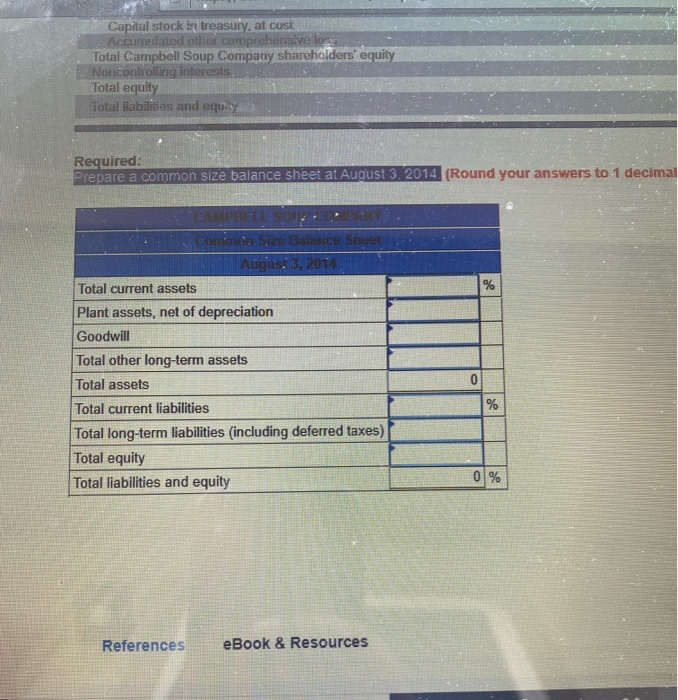

Consolidated Balance Sheets (Millions, except per share amounts) August 3, 2014 $ 232 670 1,016 182 2.100 2.318 2,433 1,175 87 $8,113 $1,771 527 553 101 Current assets Cash and cash equivalents Accounts receivable, net Inventories Other current assets Current assets of discontinued operations held for sale Total current assets Plant assets, net of depreciation Goodwill Other intangible assets, net of amortization Other assets Non-current assets of discontinued operations held for sale Total assets Current liabilities Short-term borrowings Payable to suppliers and others Accrued liabilities Dividend payable Accrued income taxes Current liabilities of discontinued operations held for sale Total current liabilities Long-term debt Deferred taxes Other liabilities Non-current liabilities of discontinued operations held for sale Total liabilities Commitments and Contingencies Campbell Soup Company shareholders' equity Preferred stock, authorized 40 shares, none issued Capital stock, S.0375 par value, authorized 560 shares, issued 323 shares Additional paid-in capital Earnings retained in the business Capital stock in treasury, at cost Accumulated other comprehensive loss Total Campbell Soup Company shareholders' equity Noncontrolling interests Total equity Total liabilities and equity 2.989 2.244 548 729 6,510 12 330 2,198 (356) (569) 1615 (12) 1,603 $8,113 Capital stock in treasury, at cost Accumulated other comprehensive lo Total Campbell Soup Company shareholders' equily Non controlling interesis, Total equity Total liabilities and equity Required: Prepare a common size balance sheet at August 3, 2014 (Round your answers to 1 decimar CAMPBELL SO P ANY Comic Size Balance Sheet Augus. 3, 2014 Total current assets Plant assets, net of depreciation Goodwill Total other long-term assets Total assets Total current liabilities Total long-term liabilities (including deferred taxes) Total equity Total liabilities and equity 0 % References eBook & Resources

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts