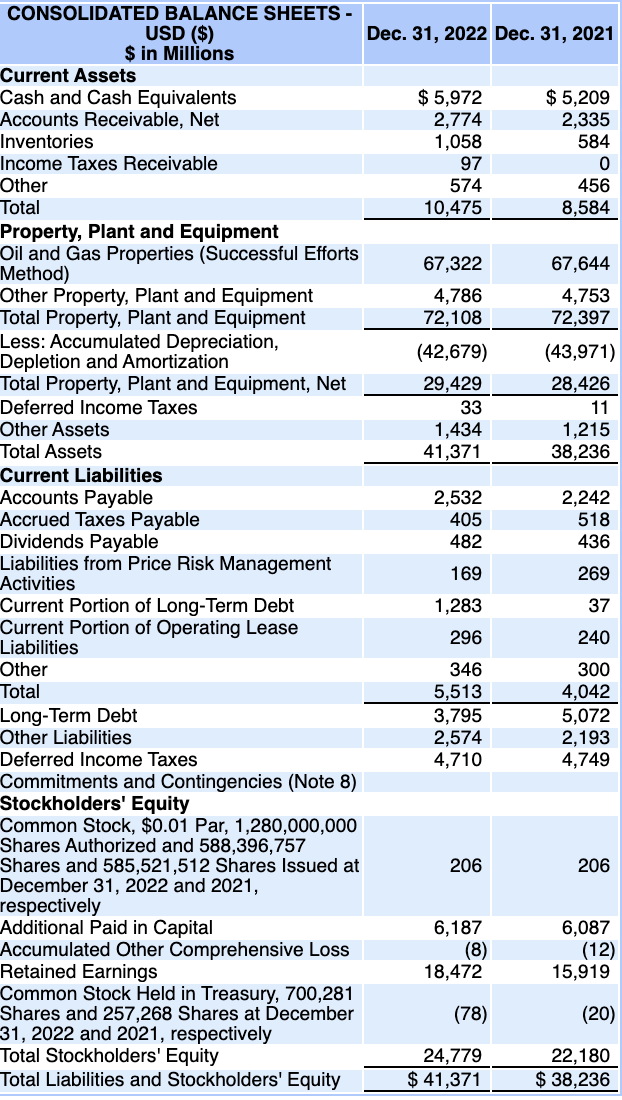

Question: CONSOLIDATED BALANCE SHEETS - USD ($) Dec. 31, 2022 Dec. 31, 2021 $ in Millions Current Assets Cash and Cash Equivalents Accounts Receivable, Net Inventories

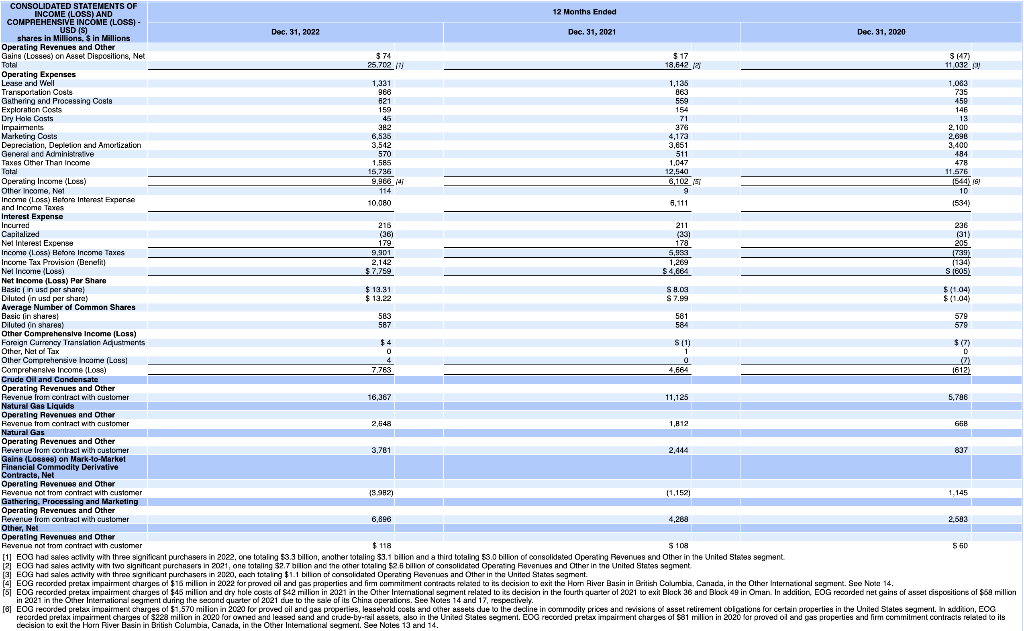

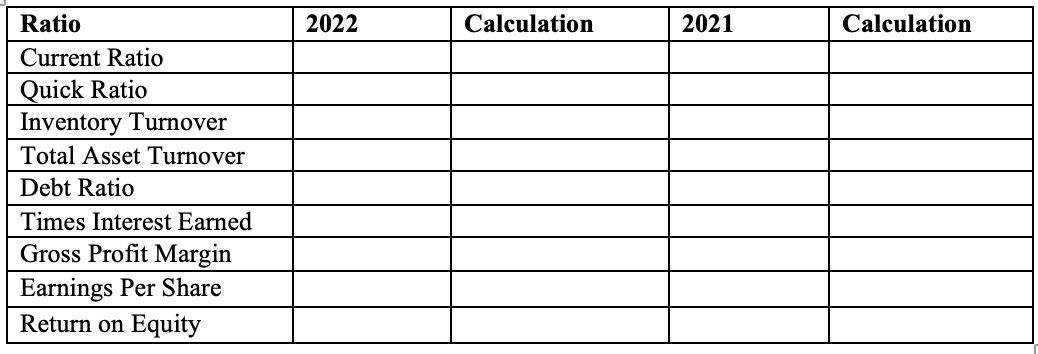

CONSOLIDATED BALANCE SHEETS - USD (\$) Dec. 31, 2022 Dec. 31, 2021 $ in Millions Current Assets Cash and Cash Equivalents Accounts Receivable, Net Inventories Income Taxes Receivable Other Total Property, Plant and Equipment Oil and Gas Properties (Successful Efforts Method) Other Property, Plant and Equipment Total Property, Plant and Equipment Less: Accumulated Depreciation, Depletion and Amortization Total Property, Plant and Equipment, Net Deferred Income Taxes Other Assets Total Assets \begin{tabular}{r|r|} \hline 67,322 & 67,644 \\ \hline 4,786 & 4,753 \\ 72,108 & 72,397 \\ \hline(42,679) & (43,971) \\ \hline 29,429 & 28,426 \\ \hline 33 & 11 \\ \hline 1,434 & 1,215 \\ \hline 41,371 \\ \hline \end{tabular} Current Liabilities Accounts Payable Accrued Taxes Payable Dividends Payable Liabilities from Price Risk Management Activities Current Portion of Long-Term Debt Current Portion of Operating Lease Liabilities Other Total Long-Term Debt Other Liabilities Deferred Income Taxes Commitments and Contingencies (Note 8) Stockholders' Equity Common Stock, \$0.01 Par, 1,280,000,000 Shares Authorized and 588,396,757 Shares and 585,521,512 Shares Issued at 206 December 31, 2022 and 2021, respectively Additional Paid in Capital Accumulated Other Comprehensive Loss Retained Earnings Common Stock Held in Treasury, 700,281 Shares and 257,268 Shares at December (78) (20) 31,2022 and 2021, respectively Total Stockholders' Equity Total Liabilities and Stockholders' Equity \begin{tabular}{rr} 24,779 & 22,180 \\ \hline$41,371 & $38,236 \\ \hline \end{tabular} CONSOLIDATED STATEMENTS OF INCOME (LOSS) AND COMPAEHENSIVE INCOME (LOSS) - [3] EoG had seles acthity with two significant purchasers in z021, one totaling $2.7 bilion and the other totaing $2.6 billion of conselidated Openating Revenues and Other in the United States gegment. cecision to exit the Hom Fiver Basin in British Columbia, Canads, in the Cher International segmert. See Noles 13 ard 14 \begin{tabular}{|l|l|l|l|l|} \hline Ratio & 2022 & Calculation & 2021 & Calculation \\ \hline Current Ratio & & & & \\ \hline Quick Ratio & & & & \\ \hline Inventory Turnover & & & & \\ \hline Total Asset Turnover & & & & \\ \hline Debt Ratio & & & & \\ \hline Times Interest Earned & & & & \\ \hline Gross Profit Margin & & & & \\ \hline Earnings Per Share & & & & \\ \hline Return on Equity & & & & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts