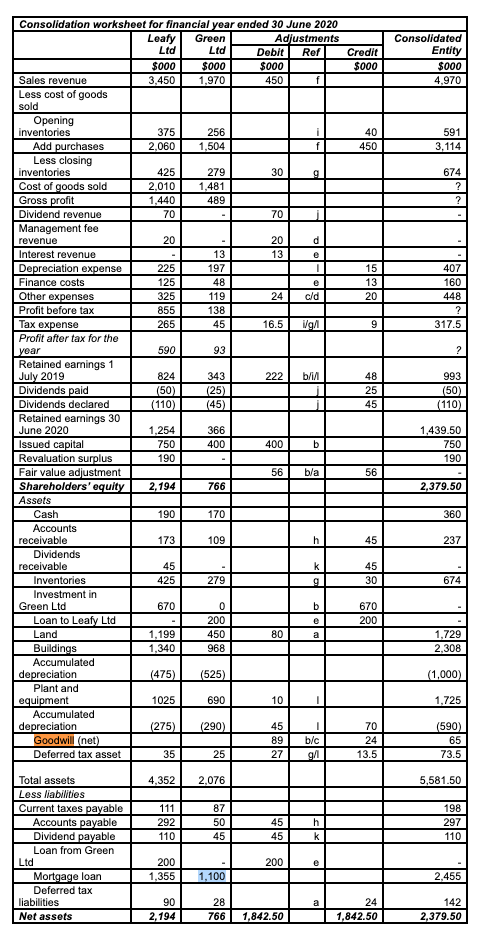

Question: Consolidated Entity $000 4,970 591 3,114 674 ? e 407 160 448 ? 317.5 ? Consolidation worksheet for financial year ended 30 June 2020 Leaty

Consolidated Entity $000 4,970 591 3,114 674 ? e 407 160 448 ? 317.5 ? Consolidation worksheet for financial year ended 30 June 2020 Leaty Green Adjustments Ltd Ltd Debit Ref Credit $000 $000 $000 $000 Sales revenue 3,450 1,970 450 f Less cost of goods sold Opening inventories 375 256 40 Add purchases 2,060 1,504 f 450 Less closing inventories 425 279 30 g Cost of goods sold 2,010 1,481 Gross profit 1,440 489 Dividend revenue 70 70 Management fee revenue 20 20 d Interest revenue 13 13 e Depreciation expense 225 197 15 Finance costs 125 48 13 Other expenses 325 119 24 cld 20 Profit before tax 855 138 Tax expense 265 45 16.5 ig 9 Profit after tax for the year 590 93 Retained earnings 1 July 2019 824 343 222 b/i/ 48 Dividends paid (25) 25 Dividends declared (110) (45) 45 Retained earnings 30 June 2020 1,254 366 Issued capital 750 400 400 b Revaluation surplus 190 Fair value adjustment 56 b/a 56 Shareholders' equity 2,194 766 Assets Cash 190 170 Accounts receivable 173 109 h 45 Dividends receivable 45 k 45 Inventories 425 279 9 30 Investment in Green Ltd 670 0 b 670 Loan to Leafy Ltd 200 200 Land 1,199 450 80 Buildings 1.340 968 Accumulated depreciation (475) (525) Plant and equipment 1025 690 10 Accumulated depreciation (275) (290) 45 1 70 Goodwill (net) 89 b/c 24 Deferred tax asset 35 25 27 g/1 13.5 (50) 993 (50) (110) 1,439.50 750 190 2,379.50 360 237 674 e a 1,729 2.308 (1,000) 1,725 (590) 65 73.5 4,352 2,076 5,581.50 111 292 110 87 50 45 45 45 h k 198 297 110 Total assets Less liabilities Current taxes payable Accounts payable Dividend payable Loan from Green Ltd Mortgage loan Deferred tax liabilities Net assets 200 e 200 1,355 1,100 2,455 a 90 2,194 28 766 24 1,842.50 142 2,379.50 1,842.50 Goodwill is an asset of which entity? O a. The consolidated entity O b. Leafy Ltd c. All of the above O d. Green Ltd

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts