Question: constant ROA Save Submit Assignment for Grading Problem 8-09 Question 2 of 3 Check My Work eBook Problem 8-09 You are valuing a bank. The

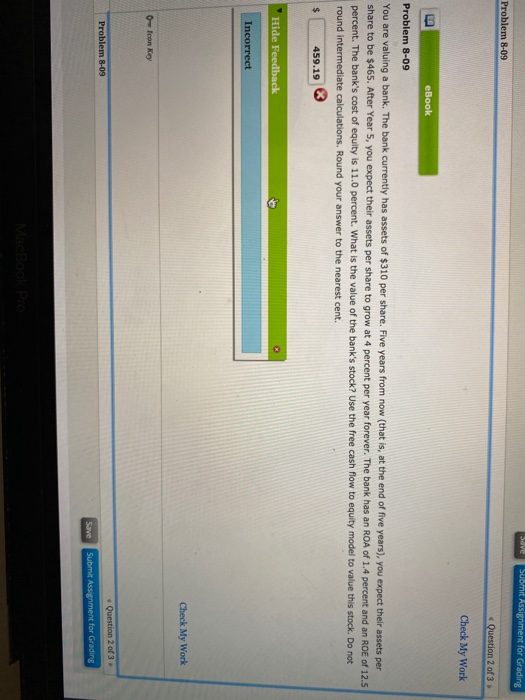

Save Submit Assignment for Grading Problem 8-09 Question 2 of 3 Check My Work eBook Problem 8-09 You are valuing a bank. The bank currently has assets of $310 per share. Five years from now (that is, at the end of five years), you expect their assets per share to be $465. After Year 5, you expect their assets per share to grow at 4 percent per year forever. The bank has an ROA of 1.4 percent and an ROE of 12.5 percent. The bank's cost of equity is 11.0 percent. What is the value of the bank's stock? Use the free cash flow to equity model to value this stock. Do not round intermediate calculations. Round your answer to the nearest cent. $ 459.19 Hide Feedback Incorrect Check My Work 0-Icon Key Problem 8-09 Question 2 of 3 Submit Assignment for Grading Save Problem 8-08 A company had $16 of sales per share for the year that just ended. You expect the company to grow their sales at 6.5 percent for the next five years. After that, you expect the company to grow 3.75 percent in perpetuity. The company has a 15 percent ROE and you expect that to continue forever. The company's net margins are 6 percent and the cost of equity is 8 percent. Use the free cash flow to equity model to value this stock. Do not round intermediate calculations Round your answer to the nearest cent. Check My Work 0--Icon Key

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts