Question: Construct a balance sheet construct the income statement construct the same of cash flow assuming the firms spend additional 250 on PPE and reduce inventories

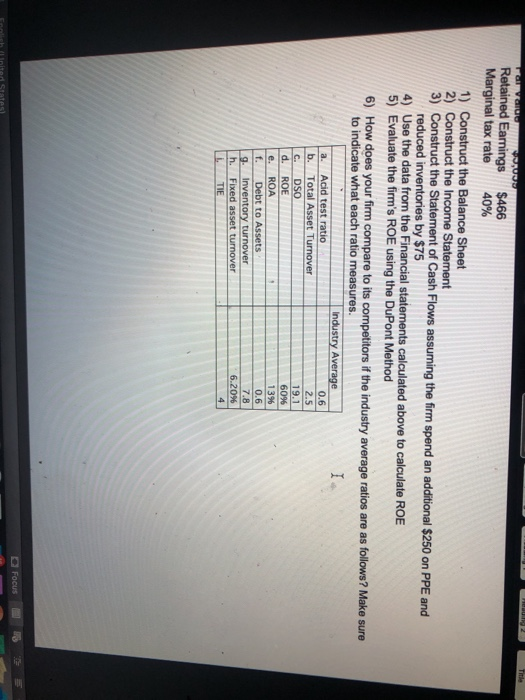

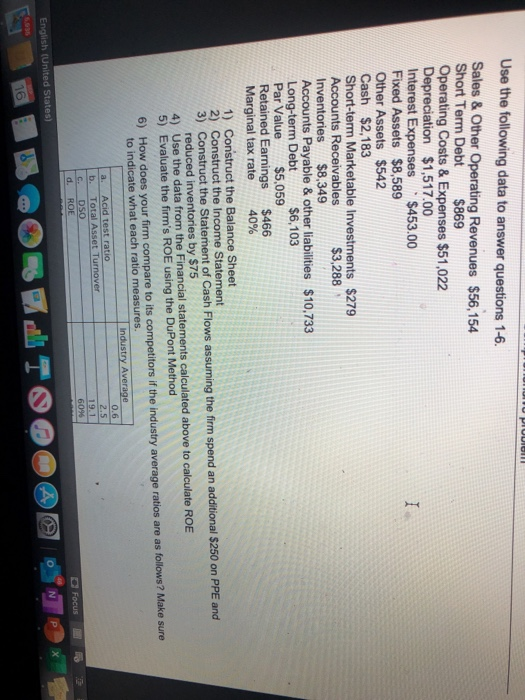

To Val Retained Earnings $466 Marginal tax rate 40% 1) Construct the Balance Sheet 2) Construct the Income Statement 3) Construct the Statement of Cash Flows assuming the firm spend an additional $250 on PPE and reduced inventories by $75 4) Use the data from the Financial statements calculated above to calculate ROE 5) Evaluate the firm's ROE using the DuPont Method 6) How does your firm compare to its competitors if the industry average ratios are as follows? Make sure to indicate what each ratio measures. Industry Average a. Acid test ratio b. Total Asset Turnover C. DSO d. ROE 60% e. ROA 1396 Debt to Assets 0.6 Inventory turnover 7.8 h. Fixed asset turnover 6.20% 0.6 TIE Focus Use the following data to answer questions 1-6. Sales & Other Operating Revenues $56,154 Short Term Debt $869 Operating Costs & Expenses $51,022 Depreciation $1,517.00 Interest Expenses $453.00 Fixed Assets $8,589 Other Assets $542 Cash $2,183 Short-term Marketable Investments $279 Accounts Receivables $3,288 Inventories $8,349 Accounts Payable & other liabilities $10,733 Long-term Debt $6,103 Par Value $5,059 Retained Earnings $466 Marginal tax rate 40% 1) Construct the Balance Sheet 2) Construct the Income Statement 3) Construct the Statement of Cash Flows assuming the firm spend an additional $250 on PPE and reduced inventories by $75 4) Use the data from the Financial statements calculated above to calculate ROE 5) Evaluate the firm's ROE using the DuPont Method 6) How does your firm compare to its competitors if the industry average ratios are as follows? Make sure to indicate what each ratio measures. Industry Average 0.6 a. Acid test ratio 2.5 b. Total Asset Turnover C DSO d. ROE Focus 6096 RS English (United States)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts