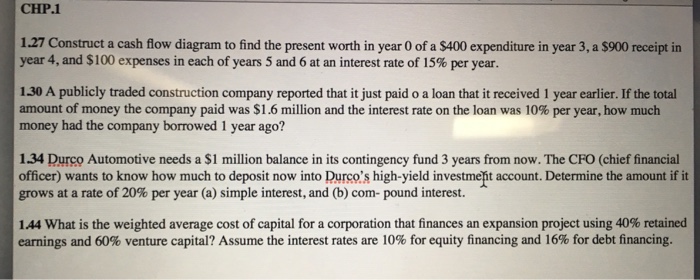

Question: Construct a cash flow diagram to find the present worth in year 0 of a exist400 expenditure in year 3, a exist900 receipt in year

Construct a cash flow diagram to find the present worth in year 0 of a exist400 expenditure in year 3, a exist900 receipt in year 4, and exist100 expenses in each of years 5 and 6 at an interest rate of 15% per year. A publicly traded construction company reported that it just paid o a loan that it received 1 year earlier. If the total amount of money the company paid was exist1.6 million and the interest rate on the loan was 10% per year, how much money had the company borrowed 1 year ago? Durco Automotive needs a exist1 million balance in its contingency fund 3 years from now. The CFO (chief financial officer) wants to know how much to deposit now into Durco's high-yield investment account. Determine the amount if it grows at a rate of 20% per year (a) simple interest, and (b) com- pound interest. What is the weighted average cost of capital for a corporation that finances an expansion project using 40% retained earnings and 60% venture capital? Assume the interest rates are 10% for equity financing and 16% for debt financing

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts