Question: Construct a decision tree using PrecisisonTree. The Acme Company is trying to decide whether to market a new product. As in many new-product situations, there

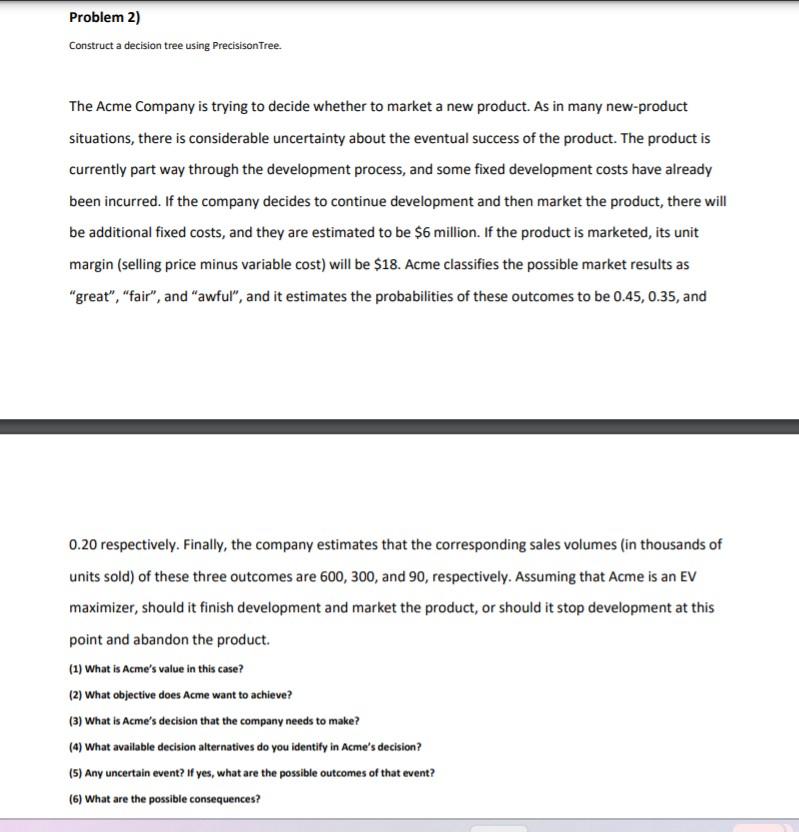

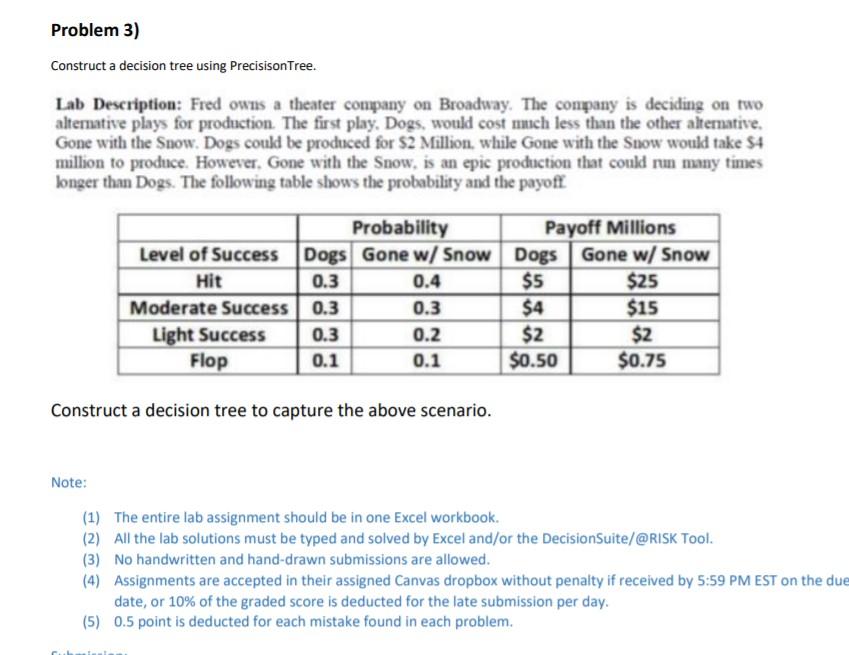

Construct a decision tree using PrecisisonTree. The Acme Company is trying to decide whether to market a new product. As in many new-product situations, there is considerable uncertainty about the eventual success of the product. The product is currently part way through the development process, and some fixed development costs have already been incurred. If the company decides to continue development and then market the product, there will be additional fixed costs, and they are estimated to be $6 million. If the product is marketed, its unit margin (selling price minus variable cost) will be $18. Acme classifies the possible market results as "great", "fair", and "awful", and it estimates the probabilities of these outcomes to be 0.45,0.35, and 0.20 respectively. Finally, the company estimates that the corresponding sales volumes (in thousands of units sold) of these three outcomes are 600, 300, and 90, respectively. Assuming that Acme is an EV maximizer, should it finish development and market the product, or should it stop development at this point and abandon the product. (1) What is Acme's value in this case? (2) What objective does Acme want to achieve? (3) What is Acme's decision that the company needs to make? (4) What available decision alternatives do you identify in Acme's decision? (5) Any uncertain event? If yes, what are the possible outcomes of that event? (6) What are the possible consequences? Construct a decision tree using PrecisisonTree. Lab Description: Fred owns a theater company on Broadway. The company is deciding on two altemative plays for production. The first play, Dogs, would cost much less than the other altemative. Gone with the Snow. Dogs could be produced for \$2 Million. while Gone with the Snow would take $4 million to produce. However, Gone with the Snow, is an epic production that could run many times longer than Dogs. The following table shows the probability and the payoff Construct a decision tree to capture the above scenario. Note: (1) The entire lab assignment should be in one Excel workbook. (2) All the lab solutions must be typed and solved by Excel and/or the DecisionSuite/@RISK Tool. (3) No handwritten and hand-drawn submissions are allowed. (4) Assignments are accepted in their assigned Canvas dropbox without penalty if received by 5:59 PM EST on the du date, or 10% of the graded score is deducted for the late submission per day. (5) 0.5 point is deducted for each mistake found in each problem. Construct a decision tree using PrecisisonTree. The Acme Company is trying to decide whether to market a new product. As in many new-product situations, there is considerable uncertainty about the eventual success of the product. The product is currently part way through the development process, and some fixed development costs have already been incurred. If the company decides to continue development and then market the product, there will be additional fixed costs, and they are estimated to be $6 million. If the product is marketed, its unit margin (selling price minus variable cost) will be $18. Acme classifies the possible market results as "great", "fair", and "awful", and it estimates the probabilities of these outcomes to be 0.45,0.35, and 0.20 respectively. Finally, the company estimates that the corresponding sales volumes (in thousands of units sold) of these three outcomes are 600, 300, and 90, respectively. Assuming that Acme is an EV maximizer, should it finish development and market the product, or should it stop development at this point and abandon the product. (1) What is Acme's value in this case? (2) What objective does Acme want to achieve? (3) What is Acme's decision that the company needs to make? (4) What available decision alternatives do you identify in Acme's decision? (5) Any uncertain event? If yes, what are the possible outcomes of that event? (6) What are the possible consequences? Construct a decision tree using PrecisisonTree. Lab Description: Fred owns a theater company on Broadway. The company is deciding on two altemative plays for production. The first play, Dogs, would cost much less than the other altemative. Gone with the Snow. Dogs could be produced for \$2 Million. while Gone with the Snow would take $4 million to produce. However, Gone with the Snow, is an epic production that could run many times longer than Dogs. The following table shows the probability and the payoff Construct a decision tree to capture the above scenario. Note: (1) The entire lab assignment should be in one Excel workbook. (2) All the lab solutions must be typed and solved by Excel and/or the DecisionSuite/@RISK Tool. (3) No handwritten and hand-drawn submissions are allowed. (4) Assignments are accepted in their assigned Canvas dropbox without penalty if received by 5:59 PM EST on the du date, or 10% of the graded score is deducted for the late submission per day. (5) 0.5 point is deducted for each mistake found in each

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts