Question: Construct a graph of the Security Market Line given by the parameters in #5. Point out the SML returns you calculated in #5 on your

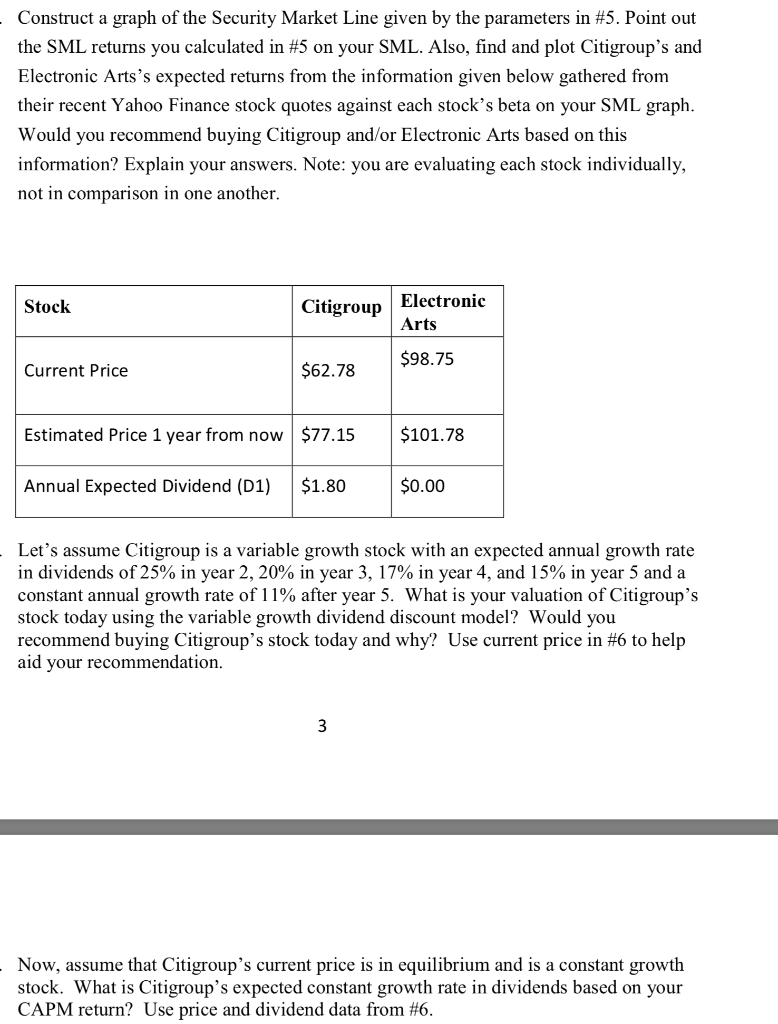

Construct a graph of the Security Market Line given by the parameters in #5. Point out the SML returns you calculated in #5 on your SML. Also, find and plot Citigroup's and Electronic Arts's expected returns from the information given below gathered from their recent Yahoo Finance stock quotes against each stock's beta on your SML graph. Would you recommend buying Citigroup and/or Electronic Arts based on this information? Explain your answers. Note: you are evaluating each stock individually, not in comparison in one another. Stock Citigroup Electronic Arts $98.75 Current Price $62.78 Estimated Price 1 year from now $77.15$101.78 Annual Expected Dividend (D1)1.80 $0.00 Let's assume Citigroup is a variable growth stock with an expected annual growth rate in dividends of 25% in year 2, 20% in year 3, 17% in year 4, and 15% in year 5 and a constant annual growth rate of 1% after year 5. What is your valuation of Citigroup's stock today using the variable growth dividend discount model? Would you recommend buying Citigroup's stock today and why? Use current price in #6 to help aid your recommendation Now, assume that Citigroup's current price is in equilibrium and is a constant growth stock. What is Citigroup's expected constant growth rate in dividends based on your CAPM return? Use price and dividend data from #6. Construct a graph of the Security Market Line given by the parameters in #5. Point out the SML returns you calculated in #5 on your SML. Also, find and plot Citigroup's and Electronic Arts's expected returns from the information given below gathered from their recent Yahoo Finance stock quotes against each stock's beta on your SML graph. Would you recommend buying Citigroup and/or Electronic Arts based on this information? Explain your answers. Note: you are evaluating each stock individually, not in comparison in one another. Stock Citigroup Electronic Arts $98.75 Current Price $62.78 Estimated Price 1 year from now $77.15$101.78 Annual Expected Dividend (D1)1.80 $0.00 Let's assume Citigroup is a variable growth stock with an expected annual growth rate in dividends of 25% in year 2, 20% in year 3, 17% in year 4, and 15% in year 5 and a constant annual growth rate of 1% after year 5. What is your valuation of Citigroup's stock today using the variable growth dividend discount model? Would you recommend buying Citigroup's stock today and why? Use current price in #6 to help aid your recommendation Now, assume that Citigroup's current price is in equilibrium and is a constant growth stock. What is Citigroup's expected constant growth rate in dividends based on your CAPM return? Use price and dividend data from #6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts