Question: Construct a hedge portfolio and by using the binomial option pricing model and find the values of Pu and Pd; and P. Explain your answer

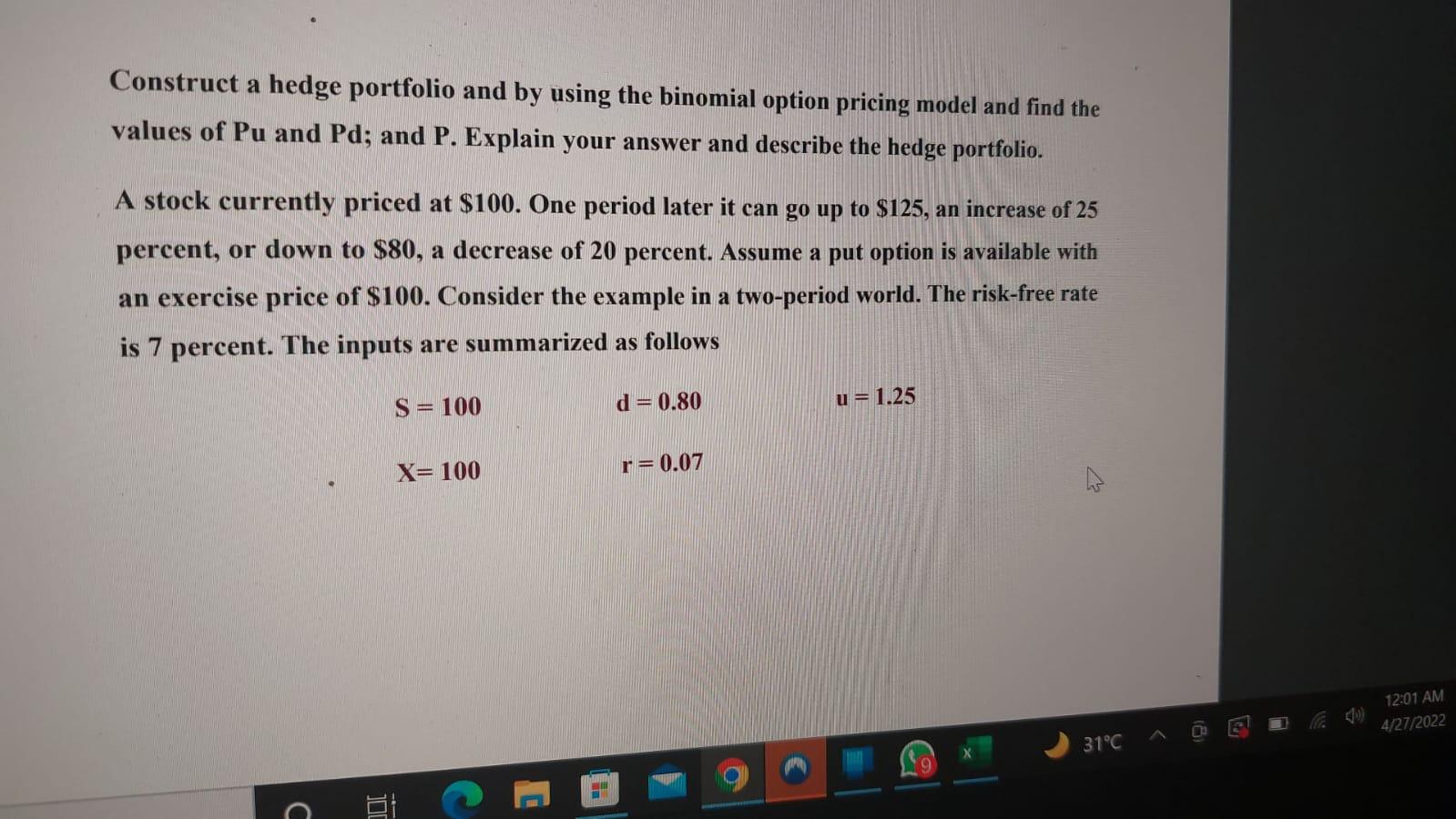

Construct a hedge portfolio and by using the binomial option pricing model and find the values of Pu and Pd; and P. Explain your answer and describe the hedge portfolio. A stock currently priced at $100. One period later it can go up to $125, an increase of 25 percent, or down to $80, a decrease of 20 percent. Assume a put option is available with an exercise price of $100. Consider the example in a two-period world. The risk-free rate is 7 percent. The inputs are summarized as follows S = 100 d = 0.80 u= 1.25 X= 100 r= 0.07 12:01 AM 4/27/2022 31C Construct a hedge portfolio and by using the binomial option pricing model and find the values of Pu and Pd; and P. Explain your answer and describe the hedge portfolio. A stock currently priced at $100. One period later it can go up to $125, an increase of 25 percent, or down to $80, a decrease of 20 percent. Assume a put option is available with an exercise price of $100. Consider the example in a two-period world. The risk-free rate is 7 percent. The inputs are summarized as follows S = 100 d = 0.80 u= 1.25 X= 100 r= 0.07 12:01 AM 4/27/2022 31C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts