Question: Construct a market-value balance sheet for FedEx, using the information in Table 7.1 and stock prices reported in Sections 7.1 and 7.2. Assume that market

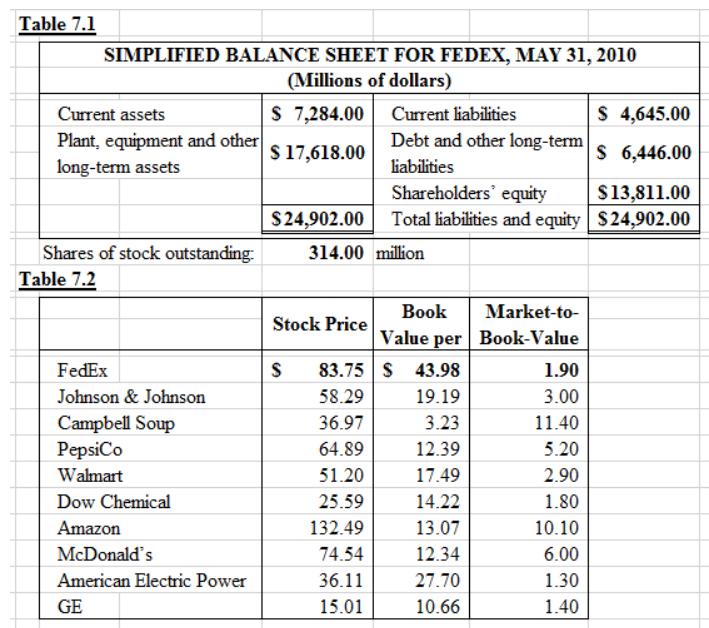

Construct a market-value balance sheet for FedEx, using the information in Table 7.1 and stock prices reported in Sections 7.1 and 7.2. Assume that market and book values are equal for current assets, current liabilities, and debt and other long-term liabilities. How much extra value shows up on the asset side of the balance sheet?n

Table 7.1 SIMPLIFIED BALANCE SHEET FOR FEDEX, MAY 31, 2010 (Millions of dollars) Current assets S 7,284.00 Current liabilities $ 4,645.00 Plant, equipment and other long-term assets Debt and other long-term $ 17,618.00 S 6,446.00 liabilities Shareholders' equity $13,811.00 $24,902.00 Total liabilities and equity $24,902.00 Shares of stock outstanding: Table 7.2 314.00 million Book Market-to- Stock Price Value per Book-Value FedEx 83.75 S 43.98 1.90 Johnson & Johnson 58.29 19.19 3.00 Campbell Soup PepsiCo 36.97 3.23 11.40 64.89 12.39 5.20 Walmart 51.20 17.49 2.90 Dow Chemical 25.59 14.22 1.80 Amazon 132.49 13.07 10.10 McDonald's 74.54 12.34 6.00 American Electric Power 36.11 27.70 1.30 GE 15.01 10.66 1.40

Step by Step Solution

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts