Question: Construct a portfolio containing (long or short) Securities 1, 2, 3 (Do not round intermediate calculations. A negative answer should be indicated by a minus

Construct a portfolio containing (long or short) Securities 1, 2, 3 (Do not round intermediate calculations. A negative answer should be indicated by a minus sign.)

Construct a portfolio containing (long or short) Securities 1, 2, 3 with a return that construct the factor portfolio for the first risk factor. (Do not round intermediate calculations. A negative answer should be indicated by a minus sign.)

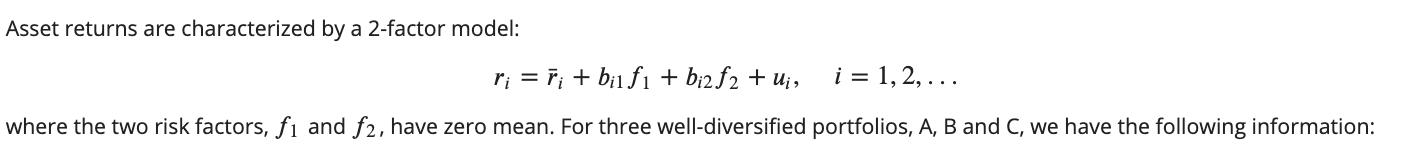

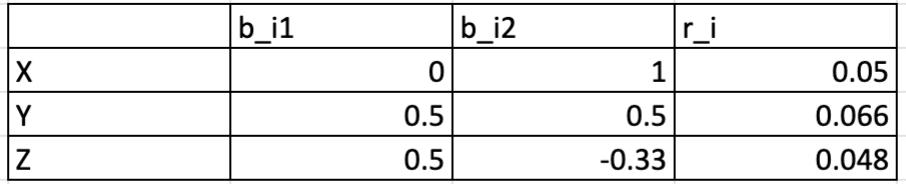

Asset returns are characterized by a 2-factor model: r = + bf + b2f2 + U, i = 1, 2, ... where the two risk factors, fi and f2, have zero mean. For three well-diversified portfolios, A, B and C, we have the following information:

Step by Step Solution

3.52 Rating (162 Votes )

There are 3 Steps involved in it

The portfolio will consist of the getting the long position in the stock X ... View full answer

Get step-by-step solutions from verified subject matter experts