Question: Construct a portfolio using the above bonds such that the portfolio is cash flow matched. 4. (19 Points) You are the manager of a fund

Construct a portfolio using the above bonds such that the portfolio is cash flow matched.

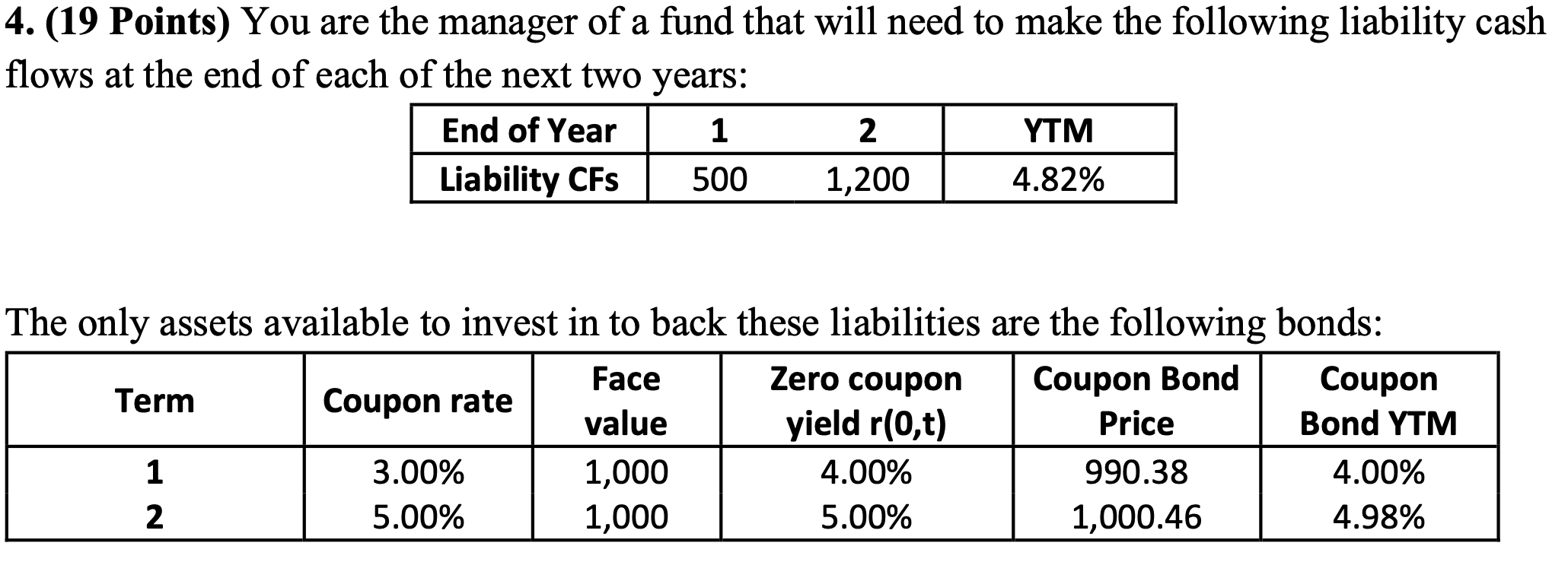

4. (19 Points) You are the manager of a fund that will need to make the following liability cash flows at the end of each of the next two years: End of Year 1 2 YTM Liability CFS 500 1,200 4.82% The only assets available to invest in to back these liabilities are the following bonds: Face Zero coupon Coupon Bond Coupon Term Coupon rate value yield r(0,t) Price Bond YTM 3.00% 1,000 4.00% 990.38 4.00% 5.00% 1,000 5.00% 1,000.46 4.98% 4. (19 Points) You are the manager of a fund that will need to make the following liability cash flows at the end of each of the next two years: End of Year 1 2 YTM Liability CFS 500 1,200 4.82% The only assets available to invest in to back these liabilities are the following bonds: Face Zero coupon Coupon Bond Coupon Term Coupon rate value yield r(0,t) Price Bond YTM 3.00% 1,000 4.00% 990.38 4.00% 5.00% 1,000 5.00% 1,000.46 4.98%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts