Question: Construct an income proforma operating statement using the following information. Subject: 44,000 SF warehouse Income: - Market rent is $9.50/SF with industrial gross terms. Industrial

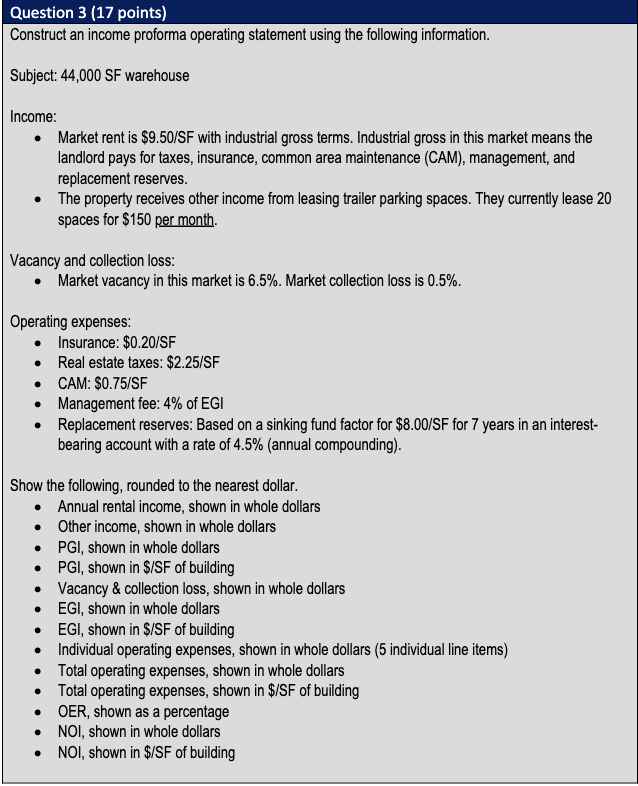

Construct an income proforma operating statement using the following information. Subject: 44,000 SF warehouse Income: - Market rent is $9.50/SF with industrial gross terms. Industrial gross in this market means the landlord pays for taxes, insurance, common area maintenance (CAM), management, and replacement reserves. - The property receives other income from leasing trailer parking spaces. They currently lease 20 spaces for $150 per month. Vacancy and collection loss: - Market vacancy in this market is 6.5%. Market collection loss is 0.5%. Operating expenses: - Insurance: $0.20/SF - Real estate taxes: \$2.25/SF - CAM: $0.75/SF - Management fee: 4% of EGI - Replacement reserves: Based on a sinking fund factor for $8.00/SF for 7 years in an interestbearing account with a rate of 4.5% (annual compounding). Show the following, rounded to the nearest dollar. - Annual rental income, shown in whole dollars - Other income, shown in whole dollars - PGI, shown in whole dollars - PGI, shown in $/SF of building - Vacancy \& collection loss, shown in whole dollars - EGI, shown in whole dollars - EGI, shown in $/SF of building - Individual operating expenses, shown in whole dollars (5 individual line items) - Total operating expenses, shown in whole dollars - Total operating expenses, shown in $/SF of building - OER, shown as a percentage - NOI, shown in whole dollars - NOI, shown in $/SF of building

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts