Question: Construct an income statement for the PREPROCESSING scenario, using from the data that has been identified in the cases. Calculate the condition under which the

- Construct an income statement for the PREPROCESSING scenario, using from the data that has been identified in the cases. Calculate the condition under which the business will be profitable (i.e. breakeven analysis in TONS). Tip fee is given in case. Finally, if the process runs at full capacity, what is the estimated annual profit? (For simplicity, for equipment/plant costs, use straight line depreciation for the life of the asset for the annual costs).

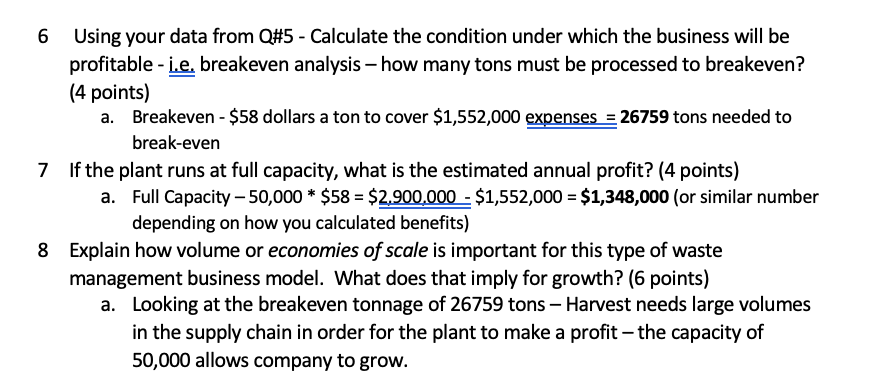

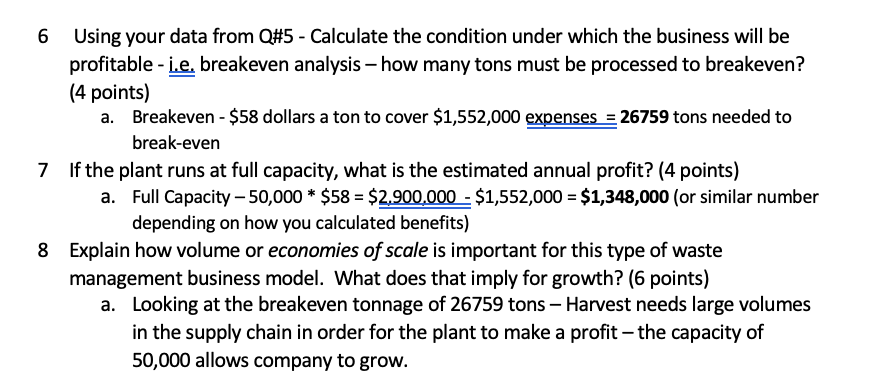

Harvest: Organic Waste Recycling with Energy Recovery (B) The management team at Harvest decided to go forward with the organic waste recycling facility in one of the large U.S. West Coast cities. Although the municipal curbside composting program seemed promising, the company decided to target commercial and industrial facilities with high organic content in their waste streams (e.g., grocery stores) as the company's main waste-generating customers. The company thought that working with a few large customers would make it easier to anticipate the quantity of incoming organic waste. After committing to developing the plant, the company quickly focused on its operational strategy. A key factor that influenced the company's operational strategy was the quality of incoming waste. Although its anaerobic digestion technology was robust to non-organic contamination, if the percentage of contaminants was too high, the quality of the compost would be too low to sell. Therefore, even though its input material was waste, as with any manufacturer, Harvest had to ensure that its raw material was of sufficiently high quality. The company considered two possible options: It could build a capital- and labor-intensive pre-processing facility to sort incoming waste (i.e., comingled organic and inorganic waste), or it could work with waste generators to source separate their waste (accepting only organic waste), which would allow Harvest to directly feed incoming waste into its anaerobic digester. Noting that the success of this project would be an example and possibly a template for how other organic-waste recycling operations could be developed, the company wanted to maximize its chances of success. Pre-Processing The pre-processing facility would sort the incoming waste, removing most of the contaminants before the waste was fed into the digestion process. This allowed Harvest to accept waste of varying levels of quality. Harvest would essentially contract with the waste generators to act as their waste disposal service (substituting for landfill or incineration) and would sort the useful organic waste in the waste stream from the inorganic contaminants. Harvest anticipated that the pre-processing plant would yield approximately 75% clean waste from the incoming waste stream (although 1%-2% contaminants would remain). Of the contaminants that were sorted out of the incoming waste stream, 40% were recyclables such as metal and plastic, 40% was unrecyclable trash, and 20% was recyclable organics. Although the recyclables were mixed with the trash and therefore degraded, the company could still sell the recyclables, but would have to dump the rest in a landfill. The net revenue from the contaminated waste stream was approximately $40 per ton (recyclable revenue minus landfill cost). The capital cost for the pre-processing facility was $4 million. A significant part of this cost was for equipment to sort the incoming waste. This equipment included air separators to pull out light plastic, star decks to separate large pieces from small, and magnets to extract metals. Also, an additional eight workers were required to staff the picking line. Harvest would contract with a labor- supply firm and anticipated paying $15 per hour for workers to run the pre-processing machinery and hand-sort the incoming waste. Additionally, a full-time technician would be required to maintain the pre-processing machinery. This machinery typically lasted eight years. Because Harvest would accept all the waste from the waste generator, it believed it could charge a tipping fee that was very close to the landfill tipping fee, approximately $80 per ton. The compost generated from this pre- processed waste input would probably contain some level of contamination, which would degrade the quality (the primary concern was glass particles). Thus, Harvest could not sell the compost, but could dispose of it for a reduced tipping fee at the landfill. The cost of this additional disposal would be $10 per ton. The equipment-intensive pre-processing facility would increase the plant's annual maintenance and utility cost by $400,000. 5. Construct an income statement fof Harvest from the revenue streams and the costs that have been identified in the case. Assume a tip Fee of $50 per Ton. Assume a 40% benefit package for salaried personnel (1.4 x salary) (5 points) Follow this Income Statement format: a. Revenue (per Ton) b. Variable Cost (per Ton) i. Revenues - Costs per ton should give you a profit or a loss per ton c. Fixed Costs (annual) d. Depreciation (annual) i. (For simplicity, for equipment/plant costs, use straight line depreciation for the life of the asset - for the annual costs) $ 50.00 Revenue per ton Tip Fee (given) electricity = 250kWh/ton .06/kWh (p5) REC = 250kWh/ton.02/kWh (p5) Compost $20/ton * 4 tons (p7) $ 15.00 $ 5.00 $ 8.00 $ 78.00 Cost per ton collection cost (p6) $ 20.00 Revenue per ton $ 58.00 Fixed Costs $ $ 70,000.00 112,000.00 670,000.00 $ Supervisor 50K (*1.4 benefits) (p6) Operators 40K (2*1.4 benefits) (p6) Maintenance (6) Depreciation Plant 10M (over 20 years) (p) Engine 2M (over 10 years) (p6) $ $ $ 500,000.00 200,000.00 1,552,000.00 Fixed Costs Per Year 26759 Break Even Ton Total Capacity for new plant (p6, p7) 50,000 Operating profit (full capacity) $ 1,348,000.00 Using your data from Q#5 - Calculate the condition under which the business will be profitable - i.e. breakeven analysis how many tons must be processed to breakeven? (4 points) a. Breakeven - $58 dollars a ton to cover $1,552,000 expenses = 26759 tons needed to break-even If the plant runs at full capacity, what is the estimated annual profit? (4 points) a. Full Capacity - 50,000 * $58 = $2,900,000 - $1,552,000 = $1,348,000 (or similar number depending on how you calculated benefits) 8 Explain how volume or economies of scale is important for this type of waste management business model. What does that imply for growth? (6 points) a. Looking at the breakeven tonnage of 26759 tons Harvest needs large volumes in the supply chain in order for the plant to make a profit - the capacity of 50,000 allows company to grow