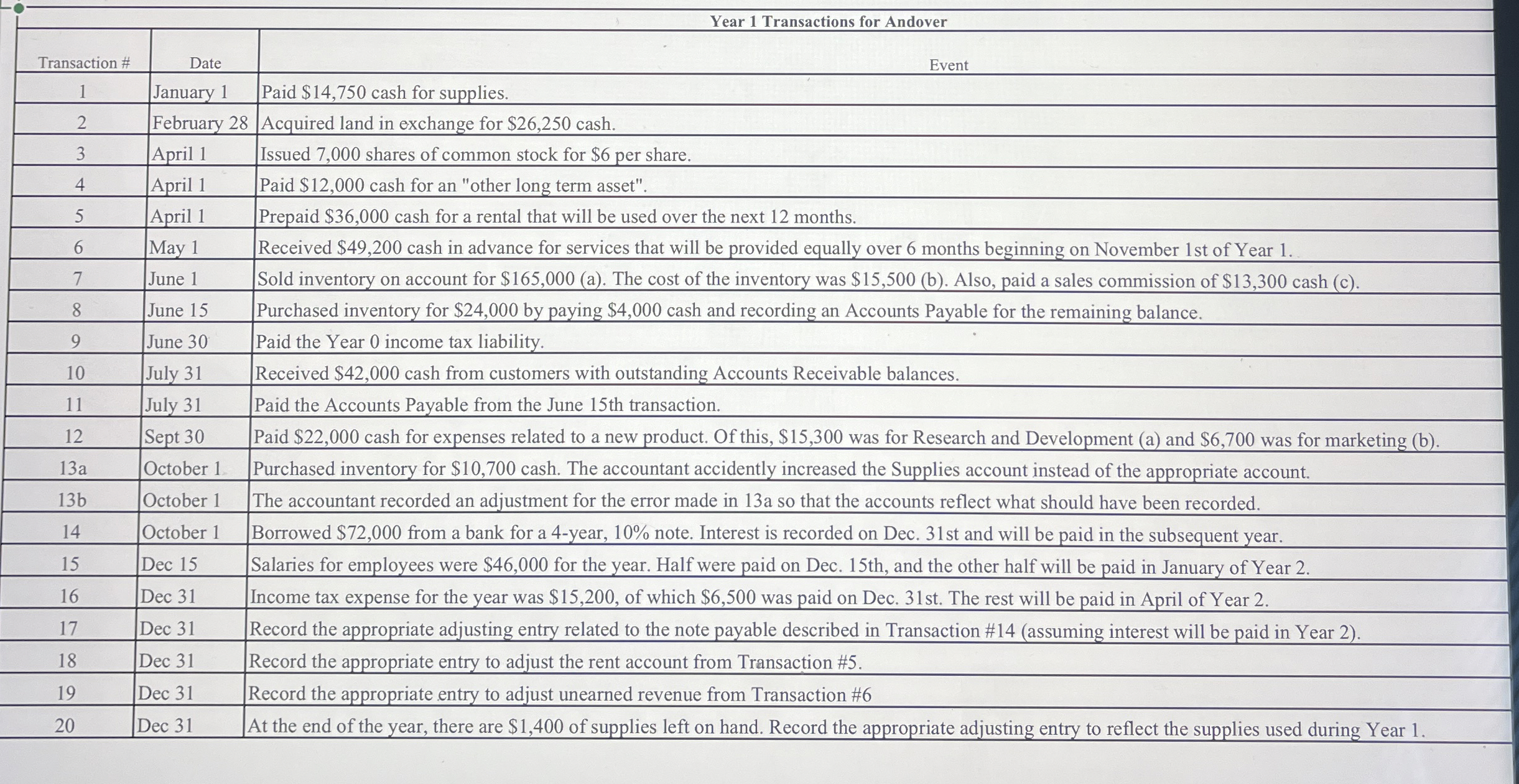

Question: Construct t a general general based off of the tabel / table [ [ Year 1 Transactions for Andover ] , [ Transaction # ,

Construct t a general general based off of the tabeltableYear Transactions for AndoverTransaction #Date,EventJanuary Paid $ cash for supplies.February Acquired land in exchange for $ cash.April Issued shares of common stock for $ per share.April Paid $ cash for an "other long term asset".April Prepaid $ cash for a rental that will be used over the next months.May Received $ cash in advance for services that will be provided equally over months beginning on November st of Year June Sold inventory on account for $a The cost of the inventory was $b Also, paid a sales commission of $ cash cJune Purchased inventory for $ by paying $ cash and recording an Accounts Payable for the remaining balance.June Paid the Year income tax liability.July Received $ cash from customers with outstanding Accounts Receivable balances.July Paid the Accounts Payable from the June th transaction.Sept Paid $ cash for expenses related to a new product. Of this, $ was for Research and Development a and $ was for marketing b aOctober Purchased inventory for $ cash. The accountant accidently increased the Supplies account instead of the appropriate account. bOctober The accountant recorded an adjustment for the error made in a so that the accounts reflect what should have been recorded.October Borrowed $ from a bank for a year, note. Interest is recorded on Dec. st and will be paid in the subsequent year.Dec Salaries for employees were $ for the year. Half were paid on Dec. th and the other half will be paid in January of Year Dec Income tax expense for the year was $ of which $ was paid on Dec. st The rest will be paid in April of Year Dec Record the appropriate adjusting entry related to the note payable described in Transaction #assuming interest will be paid in Year DecRecord the appropriate entry to adjust the rent account from Transaction #Dec Record the appropriate entry to adjust unearned revenue from Transaction #Dec At the end of the year, there are $ of supplies left on hand. Record the appropriate adjusting entry to reflect the supplies used during Year

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock