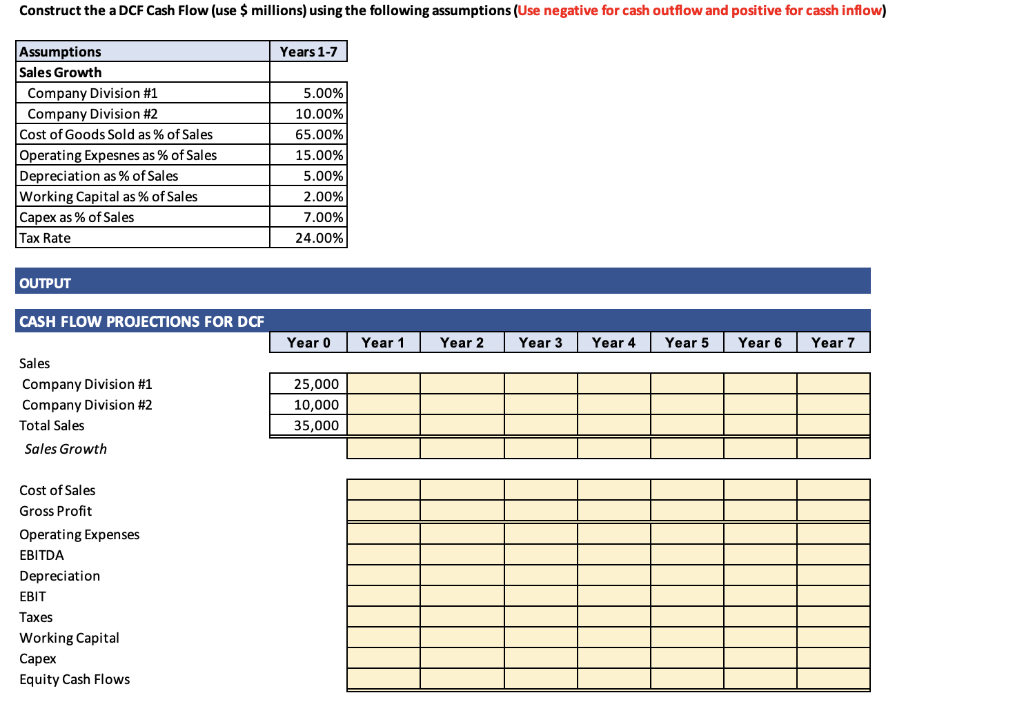

Question: Construct the a DCF Cash Flow (use $ millions) using the following assumptions (Use negative for cash outflow and positive for cassh inflow) Years 1-7

Construct the a DCF Cash Flow (use $ millions) using the following assumptions (Use negative for cash outflow and positive for cassh inflow) Years 1-7 Assumptions Sales Growth Company Division #1 Company Division #2 Cost of Goods Sold as % of Sales Operating Expesnes as % of Sales Depreciation as % of Sales Working Capital as % of Sales Capex as % of Sales Tax Rate 5.00% 10.00% 65.00% 15.00% 5.00% 2.00% 7.00% 24.00% OUTPUT CASH FLOW PROJECTIONS FOR DCF Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Sales Company Division #1 Company Division #2 Total Sales Sales Growth 25,000 10,000 35,000 Cost of Sales Gross Profit Operating Expenses EBITDA Depreciation EBIT Taxes Working Capital Capex Equity Cash Flows

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts