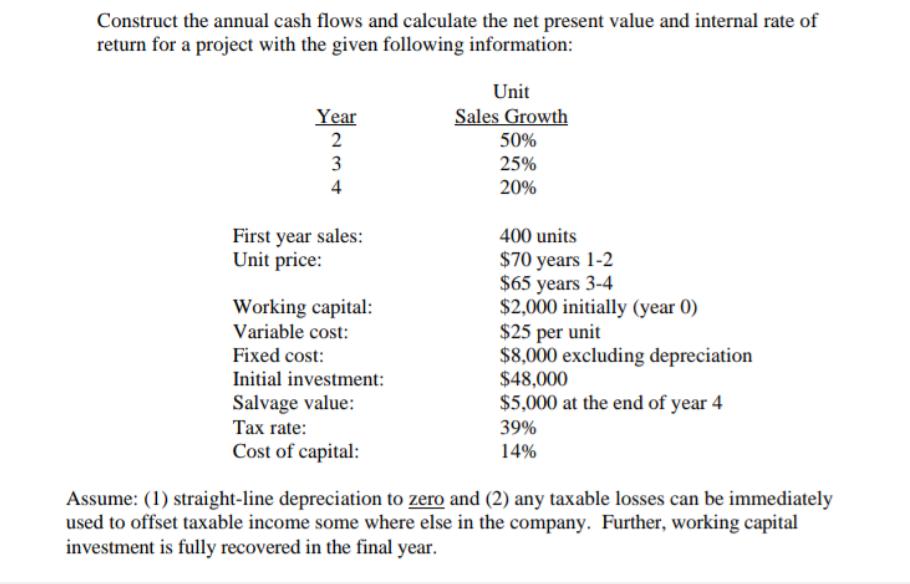

Question: Construct the annual cash flows and calculate the net present value and internal rate of return for a project with the given following information:

Construct the annual cash flows and calculate the net present value and internal rate of return for a project with the given following information: Year 2 3 4 First year sales: Unit price: Working capital: Variable cost: Fixed cost: Initial investment: Salvage value: Tax rate: Cost of capital: Unit Sales Growth 50% 25% 20% 400 units $70 years 1-2 $65 years 3-4 $2,000 initially (year 0) $25 per unit $8,000 excluding depreciation $48,000 $5,000 at the end of year 4 39% 14% Assume: (1) straight-line depreciation to zero and (2) any taxable losses can be immediately used to offset taxable income some where else in the company. Further, working capital investment is fully recovered in the final year.

Step by Step Solution

There are 3 Steps involved in it

To construct the annual cash flows and calculate the net present value NPV and internal rate of return IRR for the project we can follow these steps 1 ... View full answer

Get step-by-step solutions from verified subject matter experts