Question: Constructed a CDO utilizing three bonds. We saw that by utilizing pooling, and prioritizing default claims, we created securities with attractive characteristics. Essentially, we re-packaged

Constructed a CDO utilizing three bonds. We saw that by utilizing pooling, and prioritizing default claims, we created securities with attractive characteristics. Essentially, we re-packaged existing debt that is pari passu into priority claims on the collateral of the pool. The result is, a portion of the issued debt has reduced probability of default and is of higher quality than the collateral of the pool that securitizes the debt.

A) Assume you purchase four bonds. Create a CDO and issue four tranches of bonds. Model the pool and display the probabilities of default, the pay-offs, and recovery rates. Calculate the current price of each bond and the YTM. Calculate the total market value of the pool.

1. The collateral has a total value of 400 with 100 allocated to each bond

2. Bonds are risky, speculative grade bonds

3. Defaults are independent and occur only at maturity

4. At maturity, each bond pays 100

5. Each bond has a 15% probability of default

6. Each bond has a 30% recovery rate

7. Risk free rate is 5%

B?Issue four tranches of bonds, the size of each tranche will be as follows:

1. Senior Tranche ?

2. Mezzanine Tranche ?

3. Subordinated Mezzanine Tranche ?

4. Subordinated Tranche ?

C) Calculate the price, YTM, default probability and recovery rates for each issue. Were you successful in creating a CDO with superior characteristics than the individual bonds?

D? Given, your answer to item C, make any changes you like to the size of the tranches to improve the characteristics of the bonds being issued.

E? Why do we assume defaults are independent?

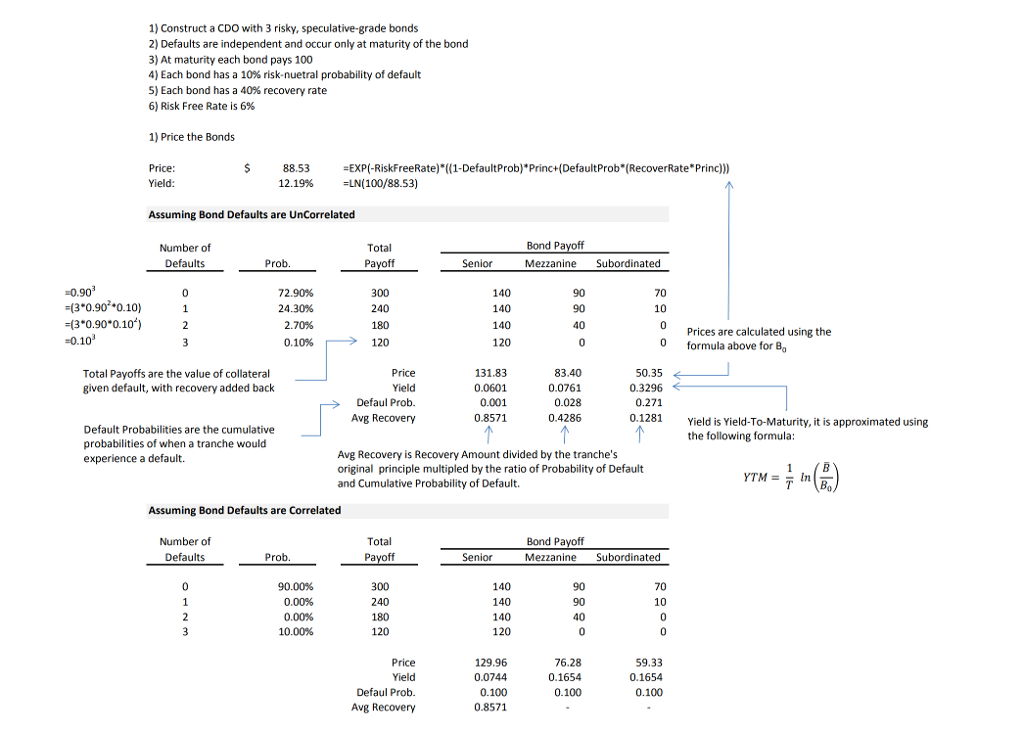

The picture spreadsheet displays the format and necessary calculations. Please follow this format.

1) Construct a CDO with 3 risky, speculative-grade bonds 2) Defaults are independent and occur only at maturity of the bond 3) At maturity each bond pays 100 4) Each bond has a 10% risk-nuetral probability of default 5) Each bond has a 40% recovery rate 6) Risk Free Rate is 6% 1) Price the Bonds $ 88.53EXP(-RiskFreeRate) ((1-DefaultProb)*Princ+(DefaultProb (RecoverRate Princ)) 12.1996 -LN(100/88.53) Assuming Bond Defaults are UnCorrelated Number of Defaults Bond Pa Mezzanine Subordinated Total Prob 0.903 r(30.90,0.10) (3 0.90 0.10 ) -0.103 72.90% 24.30% 2.70% 0.10% 140 140 140 120 300 70 10 0 Prices are calculated using the 0 formula above for B 120 131.83 0.0601 0.001 0.8571 50.35 0.3296 0.271 0.1281 Total Payoffs are the value of collateral given default, with recovery added back Price Yield Defaul Prob. Avg Recovery 83.40 0.0761 0.028 0.4286 Yield is Yield-To-Maturity, it is approximated using the following formula Default Probabilities are the cumulative probabilities of when a tranche would experience a default. Avg Recovery is Recovery Amount divided by the tranche's original principle multipled by the ratio of Probability of Default and Cumulative Probability of Default. YTM In Assuming Bond Defaults are Correlated Number of Defaults Bond Payoff Mezzanine Subordinated Total Prob Senior 90.00% 0.00% 0.00% 10.00% 140 140 140 120 70 300 240 90 120 129.96 0.0744 0.100 0.8571 76.28 0.1654 0.100 59.33 0.1654 0.100 Price Defaul Prob. Avg Recovery 1) Construct a CDO with 3 risky, speculative-grade bonds 2) Defaults are independent and occur only at maturity of the bond 3) At maturity each bond pays 100 4) Each bond has a 10% risk-nuetral probability of default 5) Each bond has a 40% recovery rate 6) Risk Free Rate is 6% 1) Price the Bonds $ 88.53EXP(-RiskFreeRate) ((1-DefaultProb)*Princ+(DefaultProb (RecoverRate Princ)) 12.1996 -LN(100/88.53) Assuming Bond Defaults are UnCorrelated Number of Defaults Bond Pa Mezzanine Subordinated Total Prob 0.903 r(30.90,0.10) (3 0.90 0.10 ) -0.103 72.90% 24.30% 2.70% 0.10% 140 140 140 120 300 70 10 0 Prices are calculated using the 0 formula above for B 120 131.83 0.0601 0.001 0.8571 50.35 0.3296 0.271 0.1281 Total Payoffs are the value of collateral given default, with recovery added back Price Yield Defaul Prob. Avg Recovery 83.40 0.0761 0.028 0.4286 Yield is Yield-To-Maturity, it is approximated using the following formula Default Probabilities are the cumulative probabilities of when a tranche would experience a default. Avg Recovery is Recovery Amount divided by the tranche's original principle multipled by the ratio of Probability of Default and Cumulative Probability of Default. YTM In Assuming Bond Defaults are Correlated Number of Defaults Bond Payoff Mezzanine Subordinated Total Prob Senior 90.00% 0.00% 0.00% 10.00% 140 140 140 120 70 300 240 90 120 129.96 0.0744 0.100 0.8571 76.28 0.1654 0.100 59.33 0.1654 0.100 Price Defaul Prob. Avg Recovery

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts