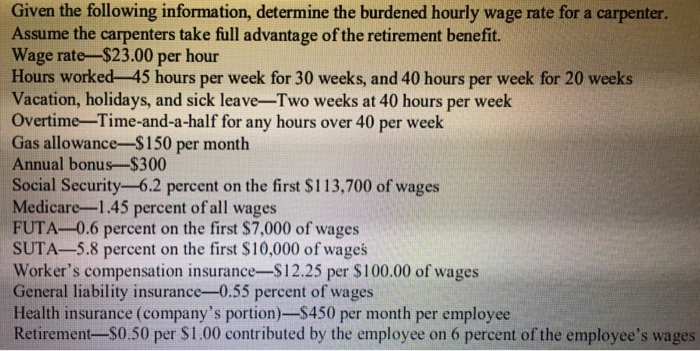

Question: CONSTRUCTION COST ESTIMATING Given the following information, determine the burdened hourly wage rate for a carpenter. Assume the carpenters take full advantage of the retirement

Given the following information, determine the burdened hourly wage rate for a carpenter. Assume the carpenters take full advantage of the retirement benefit. Wage rate-$23.00 per hour Hours worked -45 hours per week for 30 weeks, and 40 hours per week for 20 weeks Vacation, holidays, and sick leave-Two weeks at 40 hours per week Overtime-Time-and-a-half for any hours over 40 per week Gas allowance $150 per month Annual bonus $300 Social Security-6.2 percent on the first $113,700 of wages Medicare-1.45 percent of all wages FUTA-0.6 percent on the first $7,000 of wages SUTA-5.8 percent on the first $10,000 of wages Worker's compensation insurance-$12.25 per $100.00 of wages General liability insurance-0.55 percent of wages Health insurance (company's portion)-$450 per month per employee Retirement- S0.50 per S1.00 contributed by the employee on 6 percent of the employee's wages

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts