Question: Construction Project Case Study: A construction company is planning to invest in a new project with an estimated cost of $ 7 5 0 ,

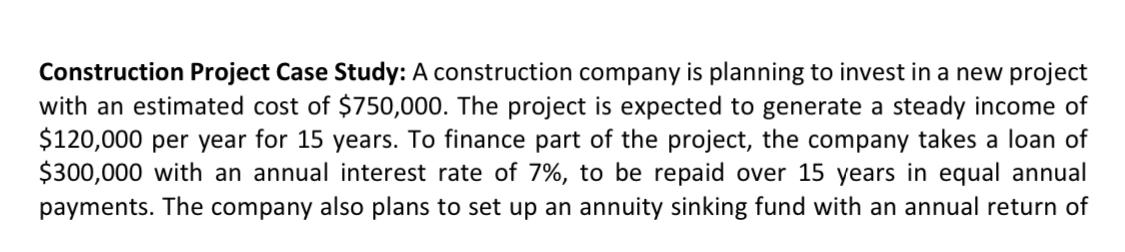

Construction Project Case Study: A construction company is planning to invest in a new project with an estimated cost of $ The project is expected to generate a steady income of $ per year for years. To finance part of the project, the company takes a loan of $ with an annual interest rate of to be repaid over years in equal annual payments. The company also plans to set up an annuity sinking fund with an annual return of to accumelate $ for future expansion at the end of the year period.

a what's the present value of the income generated by the project, and how does it compare to the initial investment, considering the company's discount rate of

b what's the annual payment for the loan, and how much will the company need to contribute to the sinking fund to reach its $ goal?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock