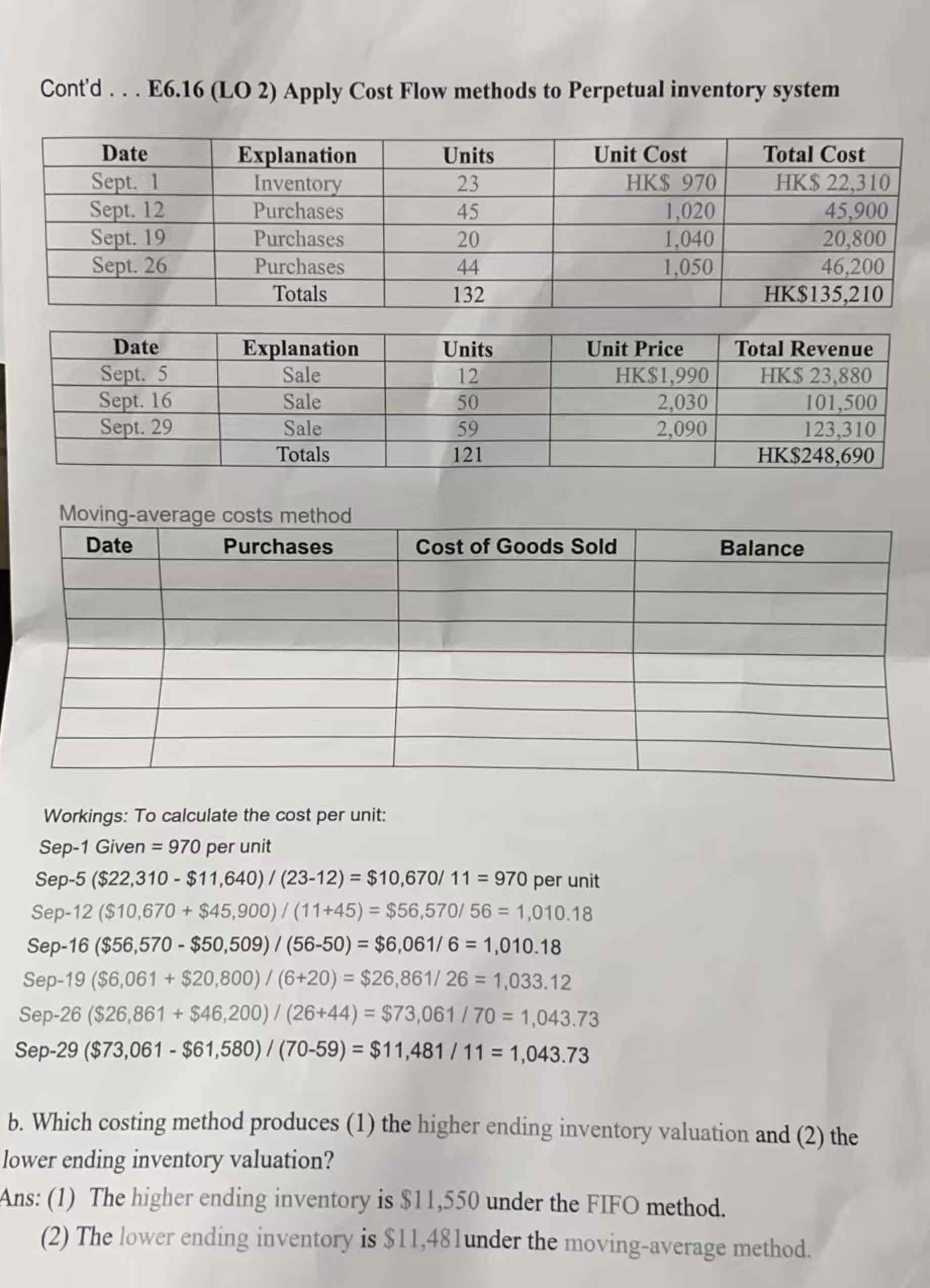

Question: Cont'd . . . E 6 . 1 6 ( LO 2 ) Apply Cost Flow methods to Perpetual inventory system Moving - average costs

Cont'd ELO Apply Cost Flow methods to Perpetual inventory system

Movingaverage costs method

Workings: To calculate the cost per unit:

Sep Given per unit

Sep$ per unit

Sep$

Sep$

Sep$

Sep$

Sep$

b Which costing method produces the higher ending inventory valuation and the

lower ending inventory valuation?

Ans: The higher ending inventory is $ under the FIFO method.

The lower ending inventory is $ under the movingaverage method.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock