Question: Content f 1 1 3 Points on 9 multiple answer question. uary 1 . 2 0 2 4 , Lowe's inc. entered into an agreement

Content

f

Points

on

multiple answer question.

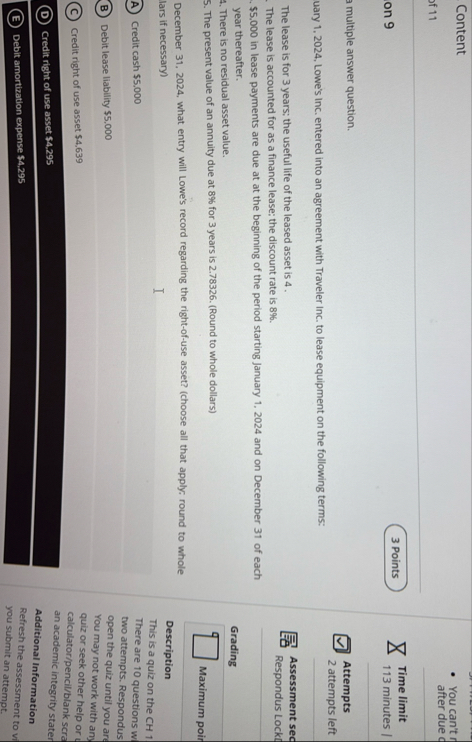

uary Lowe's inc. entered into an agreement with Traveler Inc. to lease equipment on the following terms:

The lease is for years; the useful life of the leased asset is

The lease is accounted for as a finance lease; the discount rate is

$ in lease payments are due at at the beginning of the period starting January and on December of each year thereafter.

There is no residual asset value.

The present value of an annuity due at for years is Round to whole dollars

December what entry will Lowe's record regarding the rightofuse asset? choose all that apply; round to whole lars if necessary

Credit cash $

Debit lease liability $

Credit right of use asset $

D Credit right of use asset $

E Debit amortization expense $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock