Continuation

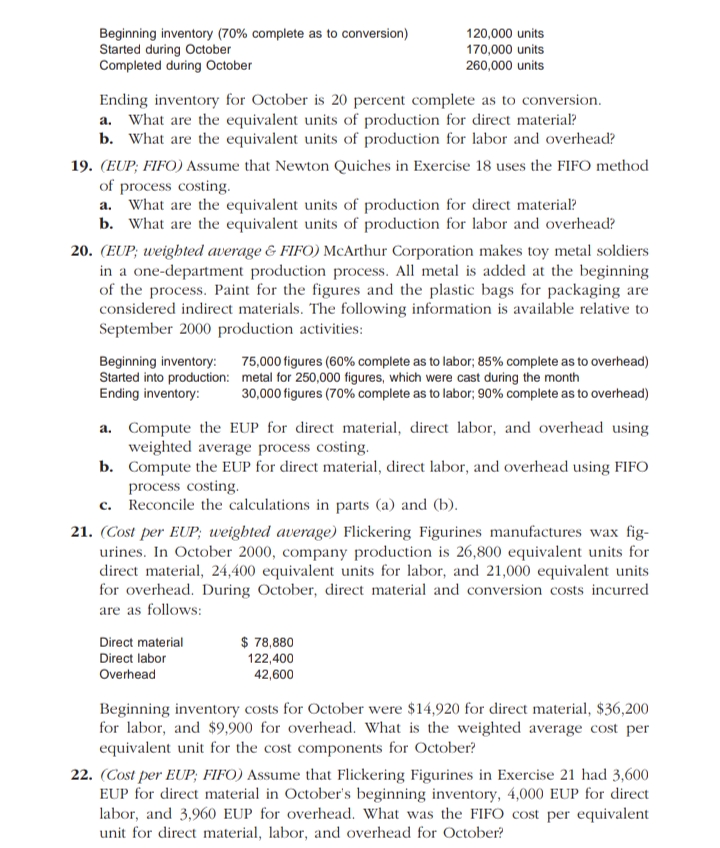

Beginning inventory (70% complete as to conversion) 120,000 units Started during October 170,000 units Completed during October 260,000 units Ending inventory for October is 20 percent complete as to conversion. a. What are the equivalent units of production for direct material? b. What are the equivalent units of production for labor and overhead? 19. (EUP; FIFO) Assume that Newton Quiches in Exercise 18 uses the FIFO method of process costing. a. What are the equivalent units of production for direct material? b. What are the equivalent units of production for labor and overhead? 20. (EUP; weighted average & FIFO) McArthur Corporation makes toy metal soldiers in a one-department production process. All metal is added at the beginning of the process. Paint for the figures and the plastic bags for packaging are considered indirect materials. The following information is available relative to September 2000 production activities: Beginning inventory: 75,000 figures (60% complete as to labor; 85% complete as to overhead) Started into production: metal for 250,000 figures, which were cast during the month Ending inventory: 30,000 figures (70% complete as to labor; 90% complete as to overhead) a. Compute the EUP for direct material, direct labor, and overhead using weighted average process costing. b. Compute the EUP for direct material, direct labor, and overhead using FIFO process costing. c. Reconcile the calculations in parts (a) and (b). 21. (Cost per EUP, weighted average) Flickering Figurines manufactures wax fig- urines. In October 2000, company production is 26,800 equivalent units for direct material, 24,400 equivalent units for labor, and 21,000 equivalent units for overhead. During October, direct material and conversion costs incurred are as follows: Direct material $ 78,880 Direct labor 122,400 Overhead 42,600 Beginning inventory costs for October were $14,920 for direct material, $36,200 for labor, and $9,900 for overhead. What is the weighted average cost per equivalent unit for the cost components for October? 22. (Cost per EUP; FIFO) Assume that Flickering Figurines in Exercise 21 had 3,600 EUP for direct material in October's beginning inventory, 4,000 EUP for direct labor, and 3,960 EUP for overhead. What was the FIFO cost per equivalent unit for direct material, labor, and overhead for October