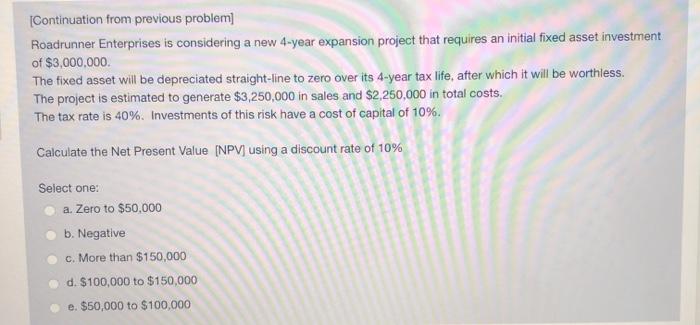

Question: [Continuation from previous problem) Roadrunner Enterprises is considering a new 4-year expansion project that requires an initial fixed asset investment of $3,000,000 The fixed asset

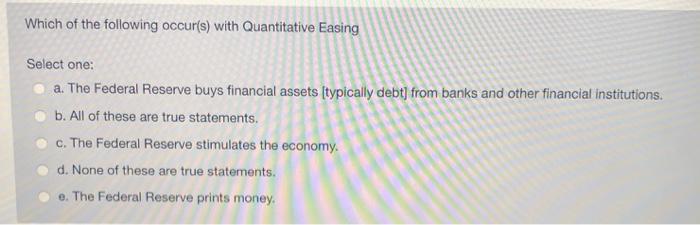

[Continuation from previous problem) Roadrunner Enterprises is considering a new 4-year expansion project that requires an initial fixed asset investment of $3,000,000 The fixed asset will be depreciated straight-line to zero over its 4-year tax life, after which it will be worthless. The project is estimated to generate $3,250,000 in sales and $2,250,000 in total costs. The tax rate is 40%. Investments of this risk have a cost of capital of 10%. Calculate the Net Present Value (NPV) using a discount rate of 10% Select one: a. Zero to $50,000 b. Negative c. More than $150,000 d. $100,000 to $150,000 e. $50,000 to $100,000 Which of the following occur(s) with Quantitative Easing Select one: a. The Federal Reserve buys financial assets (typically debt] from banks and other financial institutions. b. All of these are true statements. c. The Federal Reserve stimulates the economy. d. None of these are true statements. e. The Federal Reserve prints money

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts