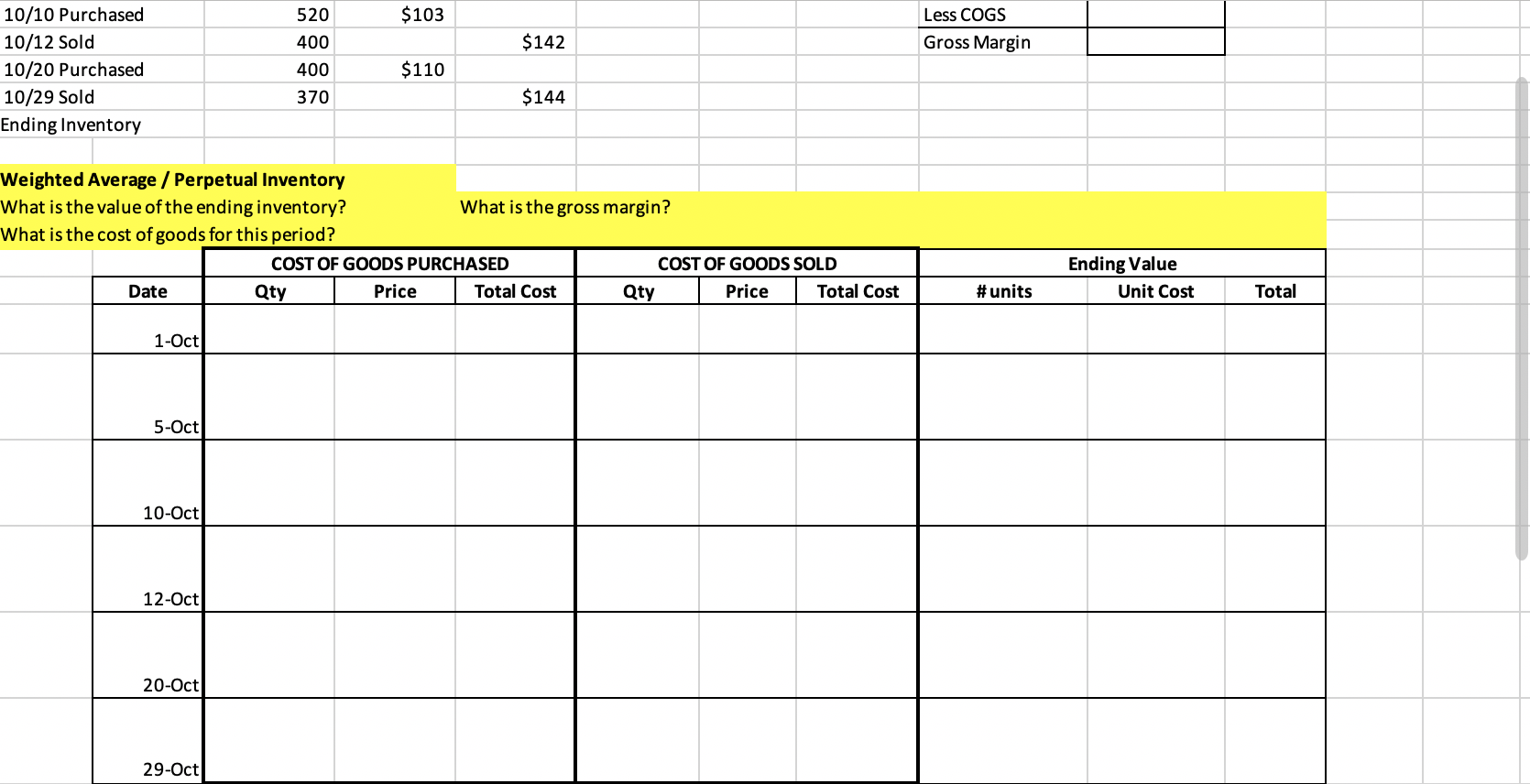

Question: , Continue $103 520 400 Less COGS Gross Margin $142 10/10 Purchased 10/12 Sold 10/20 Purchased 10/29 Sold Ending Inventory 400 $110 370 $144 Weighted

,

,

Continue

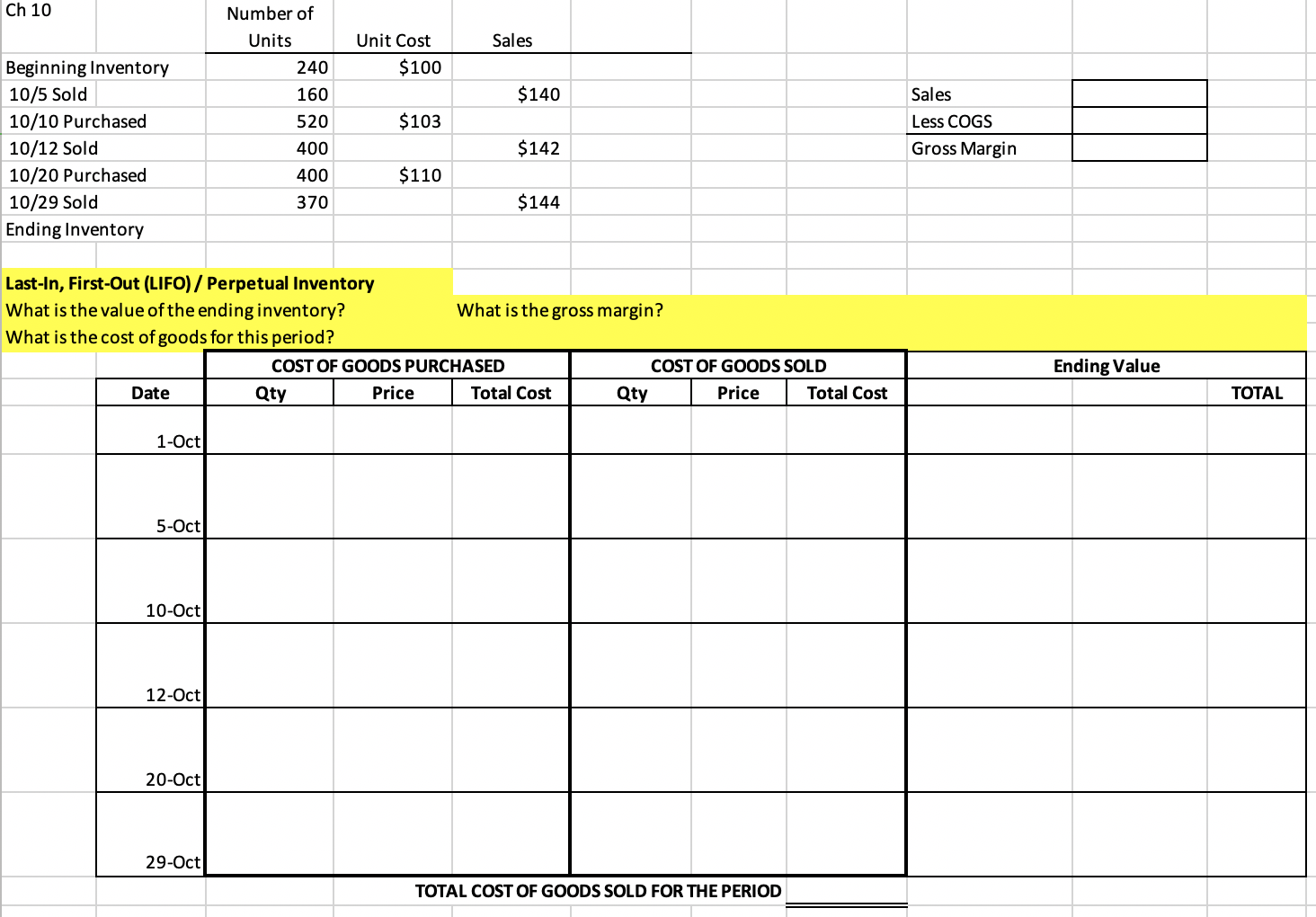

$103 520 400 Less COGS Gross Margin $142 10/10 Purchased 10/12 Sold 10/20 Purchased 10/29 Sold Ending Inventory 400 $110 370 $144 Weighted Average / Perpetual Inventory What is the value of the ending inventory? What is the gross margin? What is the cost of goods for this period? COST OF GOODS PURCHASED COST OF GOODS SOLD Date Qty Price Total Cost Qty Price Total Cost #units Ending Value Unit Cost Total 1-Oct 5-Oct 10-Oct 12-Oct 20-Oct 29-Oct Ch 10 Number of Units Sales Unit Cost $100 240 $140 $103 Beginning Inventory 10/5 Sold 10/10 Purchased 10/12 Sold 10/20 Purchased 10/29 Sold Ending Inventory 160 520 400 400 370 Sales Less COGS Gross Margin $142 $110 $144 Last-In, First-Out (LIFO) / Perpetual Inventory What is the value of the ending inventory? What is the gross margin? What is the cost of goods for this period? COST OF GOODS PURCHASED COST OF GOODS SOLD Date Qty Price Total Cost Qty Price Total Cost Ending Value TOTAL 1-Oct 5-Oct 10-Oct 12-Oct 20-Oct 29-Oct TOTAL COST OF GOODS SOLD FOR THE PERIOD

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts